Loading

Get Mt Ui-5 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT UI-5 online

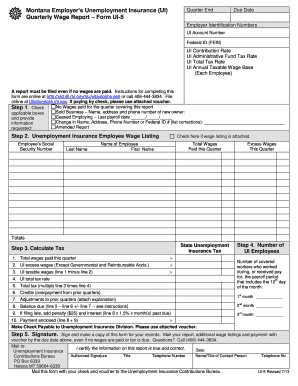

The MT UI-5 is an essential form for employers in Montana to report quarterly wages paid to employees for Unemployment Insurance. This guide will help you navigate the process of completing and submitting the form online with confidence.

Follow the steps to fill out the MT UI-5 correctly.

- Click the ‘Get Form’ button to access the MT UI-5 form online.

- Begin by entering the quarter end date and due date, along with your Employer Identification Numbers, including your UI Account Number and Federal ID (FEIN). Ensure accuracy to avoid delays.

- Select any applicable boxes regarding your business status, such as 'No Wages Paid,' 'Sold Business' with the new owner's name and contact details, or 'Ceased Employing' with the last payroll date. If there are any corrections for name, address, phone number, or Federal ID, list them clearly.

- For the Unemployment Insurance Employee Wage Listing, enter each employee's Social Security Number, last name, first name, and total wages paid this quarter. If a wage listing is attached, check the corresponding box.

- Calculate the total UI tax by first entering the total wages paid this quarter and subtracting any UI excess wages. Multiply the UI taxable wages by the UI total tax rate to get the total tax owed. Remember to include any credits and adjustments from prior quarters.

- Indicate the number of UI employees and ensure calculations of any penalties for late filing are included if applicable.

- Sign and date the form at the end. Make a copy for your records. Prepare to mail your report with any additional wage listings and payment by the specified due date, even if no wages were paid.

- Submit your completed form to the Unemployment Insurance Contributions Bureau, ensuring you include your payment and voucher, if required.

Start completing your MT UI-5 form online today to ensure timely compliance!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Certain types of payments are excluded from 940 wages, such as fringe benefits, certain retirement plan contributions, and health savings account contributions. Familiarizing yourself with these exclusions is part of navigating the MT UI-5 landscape. Knowing what does not count can help you prepare accurate filings and avoid unexpected liabilities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.