Loading

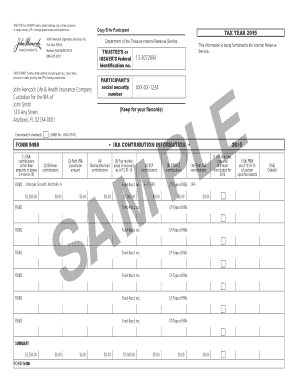

Get Corrected If Checked Omb No 1545-0747 Form 5498 Ira

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Corrected If Checked OMB No 1545-0747 FORM 5498 IRA online

Filling out the Corrected If Checked OMB No 1545-0747 FORM 5498 IRA online can seem daunting, but with clear guidance, you can navigate this process with ease. This guide is designed to provide you with step-by-step instructions to accurately complete the form and ensure that your information is submitted correctly to the Internal Revenue Service.

Follow the steps to complete the form accurately.

- Click the ‘Get Form’ button to access the Corrected If Checked OMB No 1545-0747 FORM 5498 IRA and open it in your preferred editor.

- Identify the trustee's or issuer's name and contact information. This will include the name, address, and phone number of the organization administering your IRA.

- Provide the participant's information, including their full name, address, and Social Security number. Ensure accuracy to avoid issues with the IRS.

- Fill in details regarding contributions made, including traditional IRA contributions (Box 1), rollover contributions (Box 2), Roth IRA conversions (Box 3), and any recharacterized contributions (Box 4). Be precise about amounts.

- Report the fair market value (Box 5) of the account as of December 31 of the relevant tax year. This figure is significant for evaluating your investments.

- Complete sections regarding the type of IRA involved (Box 7) and contributions made for SEP (Box 8), SIMPLE (Box 9), and Roth IRA (Box 10). Each contribution type can impact your tax reporting.

- If required, check the box for the required minimum distribution for the following tax year (Box 11). Ensure compliance to avoid penalties.

- Review all entered information for accuracy and completeness. Make any necessary corrections before proceeding.

- Finally, save your changes, download a copy of the form, and print or share it as needed to ensure you keep a record of your filing.

Start filling out your form online today to stay on top of your IRA contributions.

You can expect to receive IRS Form 5498 if you made contributions to an IRA (Individual Retirement Arrangement) in the preceding tax year. The "custodian" of your IRA, typically the bank or other institution that manages your account, will mail a copy of this form to both you and the Internal Revenue Service.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.