Get Va Freddie Mac/fannie Mae Form 3047 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the VA Freddie Mac/Fannie Mae Form 3047 online

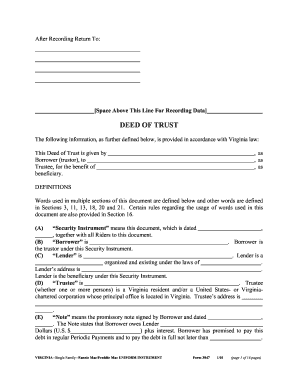

Completing the VA Freddie Mac/Fannie Mae Form 3047 online can streamline your document management process. This guide provides a step-by-step approach to help you fill out the form accurately and efficiently, ensuring compliance with Virginia law.

Follow the steps to successfully complete the VA Freddie Mac/Fannie Mae Form 3047 online.

- Press the ‘Get Form’ button to access the form. This action will allow you to obtain and open the document in an electronic format for editing.

- Begin filling out the 'Borrower' section. Enter the name of the person who is the trustor under this security instrument.

- In the 'Trustee' section, input the name of the trustee who holds the deed. Ensure that the trustee is compliant with the requirements set by Virginia law.

- Complete the 'Lender' section by filling in the name of the lender, along with their address. Confirm that this information matches the lender's records.

- In the 'Property' section, accurately describe the property being secured, including its address and jurisdiction. This is crucial for legal purposes.

- Check the applicable ‘Riders’ box section to indicate any additional agreements or riders that pertain to the loan, such as adjustable rate or balloon riders.

- Review all the information inputted to ensure accuracy. Make any necessary corrections to prevent delays in processing.

- Once all details are correct, save your changes. You can also opt to download, print, or share the completed form according to your needs.

Complete your documents online today for a smoother and more efficient process.

Freddie Mac and Fannie Mae serve as government-sponsored enterprises that help stabilize the housing market. While both provide similar services, Freddie Mac mainly focuses on smaller lenders, whereas Fannie Mae works with larger banks. Both entities support mortgage financing, and they require the VA Freddie Mac/Fannie Mae Form 3047 for certain loans. Understanding these distinctions can help you choose the best mortgage option for your needs.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.