Loading

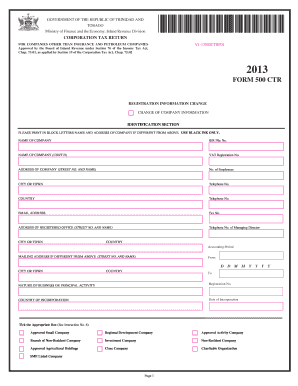

Get Tt 500 Ctr Form 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TT 500 CTR form online

Completing the TT 500 CTR form online can streamline the process of filing your corporation tax return. This guide provides clear, step-by-step instructions to help users accurately fill out the form.

Follow the steps to successfully complete your TT 500 CTR form online.

- Press the ‘Get Form’ button to retrieve the TT 500 CTR form and access it in your preferred online editor.

- Begin with the Registration Information Change section. Enter the name and address of your company using block letters and black ink only. Ensure you provide the BIR File Number and VAT Registration Number if applicable.

- Fill in the Identification Section. Include the number of employees, contact telephone number, email address, and fax number as requested.

- Complete the Accounting Period information by specifying the dates of the period you are reporting.

- Indicate the nature of your business or principal activity by selecting the appropriate option from the provided list.

- Proceed to the Computation of Corporation Tax/Business Levy Due and Paid section. Begin by entering the gross receipts or sales, and follow with chargeable profits, corporation tax calculated, and any reliefs applicable.

- In the Payable/Refund section, list the corporation tax and business levy that has been paid. Calculate any amounts payable or refundable based on the entries made in previous steps.

- Complete the General Declaration by signing and dating the form, confirming that all information is accurate and true.

- Once all sections are filled out, you can save changes, download, print, or share the completed TT 500 CTR form as needed.

Start filing your TT 500 CTR form online today for a simplified and efficient process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, even if your interest income is under $10, you are required to report it on your tax return. The Internal Revenue Service mandates that all income, regardless of the amount, should be reported. This requirement means that every dollar counts in your financial reporting. Using resources like the TT 500 CTR Form assists you in accurately documenting your income activities.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.