Loading

Get Ira Charitable Rollover Is Reauthorized - Bnicumfbborgb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRA Charitable Rollover Is Reauthorized - Bnicumfbborgb online

Filling out the IRA Charitable Rollover Is Reauthorized form can be a straightforward process, especially when you have clear instructions. This guide will walk you through each step of the online form to ensure you complete it correctly.

Follow the steps to successfully fill out the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Complete the 'Personal Information' section by providing your full name, address, and contact details. Ensure all information is accurate to avoid delays.

- In the next section labeled 'IRA Account Details', enter your IRA account number and the name of your IRA administrator.

- Proceed to the 'Donation Details' section where you will specify the amount you wish to donate from your IRA. Remember, the maximum amount allowed is $100,000.

- Input the legal name and address of the charity or church you are donating to in the designated fields. This information is crucial for proper processing.

- Review your entries for accuracy, ensuring that all required fields are filled out correctly before moving on.

- Once you are satisfied with the completed form, you have the options to save the changes, download a copy, print the form, or share it as needed.

Begin your IRA Charitable Rollover process by completing the form online today.

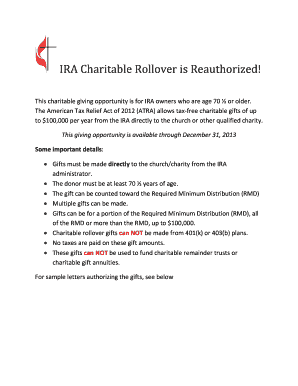

The charitable IRA rollover, or qualified charitable distribution (QCD), is a special provision allowing particular donors of age 70.5 to exclude from taxable income—and count toward their required minimum distribution—certain transfers of Individual Retirement Account (IRA) assets that are made directly to public ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.