Loading

Get Ny Char500 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR500 online

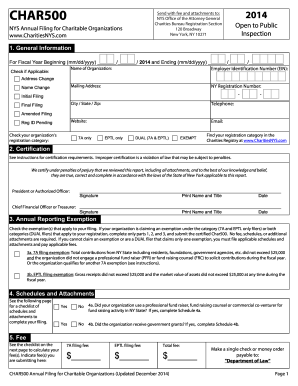

Filling out the NY CHAR500 form is essential for charitable organizations operating in New York. This guide provides a clear, step-by-step approach to help you navigate the process effectively and ensure compliance with state regulations.

Follow the steps to complete the NY CHAR500 seamlessly.

- Press the ‘Get Form’ button to access the CHAR500 form and open it in the editor.

- Begin by entering the fiscal year details at the top of the form, specifying both the beginning and ending dates using the mm/dd/yyyy format.

- Move to the certification section. All necessary officers must sign and date the form, confirming that the information is complete and accurate.

- Calculate your filing fees based on your organization type and the provided guidelines. Enter the total fee amount on the form.

Complete your filings online and ensure your organization remains compliant with New York state regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, NY CHAR500 can be filed electronically, making the process more efficient for organizations. By utilizing online filing systems, you can ensure that your documents are submitted promptly and securely. Platforms like uslegalforms facilitate this process, allowing you to track your submission and receive confirmation of your filing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.