Get Fannie Mae 3179 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fannie Mae 3179 online

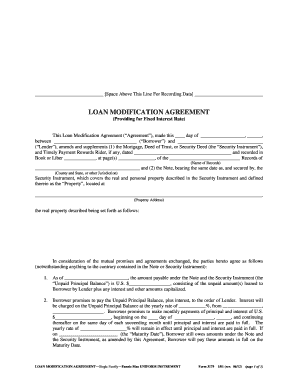

The Fannie Mae 3179 form, also known as the Loan Modification Agreement, is a crucial document for borrowers seeking to adjust their loan terms. This guide provides step-by-step instructions on how to accurately complete this form online, ensuring that users receive the necessary support throughout the process.

Follow the steps to fill out the Fannie Mae 3179 online effectively.

- Press the ‘Get Form’ button to access the document and open it in the editing interface.

- Begin by entering the date on which the agreement is made in the first blank field.

- In the following two blank spaces, provide the names of the Borrower and Lender respectively.

- Enter the date of the original Mortgage, Deed of Trust, or Security Deed in the next blank.

- Indicate the Book or Liber number and corresponding page number where the original document is recorded.

- Fill in the name of the Record, along with the county and state where the property is located.

- Complete the blank fields specifying the property address accurately, ensuring all details are correct.

- In section 1, record the Unpaid Principal Balance amount, which includes the loan amounts and any accrued interest.

- Specify the yearly interest rate in section 2, noting the start date for interest charges along with the monthly payment amount.

- Indicate the date when the first payment is due and the ongoing schedule for subsequent payments.

- In section 3, read through the conditions regarding the sale or transfer of the Property and complete any additional fields as necessary.

- Review section 4, ensuring compliance with covenants as listed, including any applicable provisions.

- Complete any fields in section 5 regarding rate adjustments and sign the form where indicated.

- Finally, save the completed document to retain changes, and choose options to download, print, or share the form as needed.

Complete your forms online today for a smoother loan modification process.

Get form

Yes, Fannie Mae 3179 may require tax returns during the underwriting process to assess your financial stability. Lenders often need two years of tax returns to verify your income and ensure eligibility for mortgage modifications. It is essential to gather and submit these documents promptly, as they can expedite the review process. For assistance, consider utilizing US Legal Forms to access the necessary documentation quickly.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.