Loading

Get Sofi Personal Loan Forbearance Request Formdocx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SoFi Personal Loan Forbearance Request Formdocx online

Filling out the SoFi Personal Loan Forbearance Request Formdocx online is a straightforward process that can help you manage your loan payments during challenging financial times. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully fill out the forbearance request form.

- Press the ‘Get Form’ button to access and open the form in your preferred editing tool.

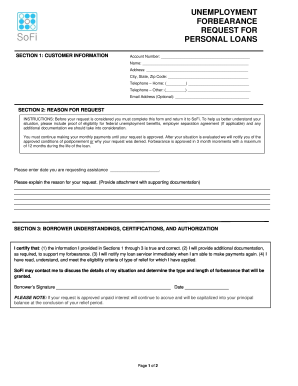

- Complete Section 1: Customer Information by filling in your account number, name, address, city, state, zip code, home telephone number, other telephone number, and optional email address.

- Move to Section 2: Reason for Request. Enter the date you are requesting assistance and provide a detailed explanation of your situation. Remember to attach any supporting documentation, such as proof of eligibility for federal unemployment benefits and an employer separation agreement, if applicable.

- In Section 3: Borrower Understandings, Certifications, and Authorization, read the certifications carefully. Confirm that the information provided is accurate, and acknowledge your responsibilities. Sign and date the section to indicate your agreement.

- Once you have filled out all required sections, review the form for accuracy and completeness.

- Send the completed form along with any necessary documents to the address provided in Section 4: Instructions for Completing the Form, or to the email listed.

- If you need further assistance, consider calling the provided support number for help.

- Finally, once everything is submitted, keep a copy of your completed form and documentation for your records.

Start filling out your SoFi Personal Loan Forbearance Request Formdocx online today!

Not all lenders allow payment deferrals. Whether you skip a full payment or make a reduced one, it is important to know that you are still liable for the outstanding balance to your lender. Your lender will add that amount to the end of your loan, during which time your account continues to accrue interest.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.