Loading

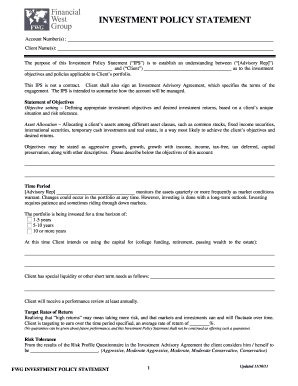

Get Print Form Clear Form Investment Policy Statement Account Number(s) : Client Name(s): The Purpose

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PRINT FORM CLEAR FORM INVESTMENT POLICY STATEMENT Account Number(s) : Client Name(s): The Purpose online

Completing the Investment Policy Statement (IPS) form online is an essential step in establishing a clear understanding of investment objectives and policies. This guide will walk you through each section of the form, ensuring a smooth and accurate completion process.

Follow the steps to successfully complete the Investment Policy Statement form.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the Account Number(s) in the designated field. This is crucial for associating the IPS with the correct account.

- Fill in the Client Name(s) field accurately to identify the individuals for whom the IPS is being created.

- In the 'Statement of Objectives' section, specify the investment objectives based on the client's situation and risk tolerance. This is a key part of the IPS and should reflect realistic financial goals.

- Indicate the time period for investment by selecting one of the options: 1-5 years, 5-10 years, or 10 or more years. This helps in understanding how funds will be allocated over time.

- Detail any special liquidity or short-term needs that the client may have in the 'Client special liquidity needs' section.

- Specify the targeted rate of return by entering the percentage the client aims to achieve over the designated time period.

- Indicate the client's risk tolerance level based on the provided options (e.g., Aggressive, Moderate, Conservative).

- Select the appropriate benchmark for performance comparison by checking one of the options (S&P 500, LA31, or LA38).

- Specify the target mix of assets by entering the percentages for each asset class: Equities, Long Term Bond Index, Short Term Bond Index, and Cash Equivalents.

- If applicable, describe any restrictions or constraints that should be placed on the investments.

- Fill in the percentage of the client’s invested assets by program and indicate if there are any third-party money manager programs involved.

- Review the section regarding authority delegated to the advisor. Confirm the advisor's discretionary authority for trading.

- Sign the document in the 'Client Signature' section and date it appropriately. If there is a joint client, the second signature must also be completed.

- After completing all sections, ensure to save the form, and choose whether to download, print, or share the Investment Policy Statement.

Complete your Investment Policy Statement online today to streamline your investment strategy.

Related links form

An investment policy statement describes a client's financial goals and investment objectives, while documenting the roles and responsibilities of all parties involved in managing portfolios, including the client's outsourced chief investment office (OCIO), board members, investment committee, investment managers and ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.