Loading

Get Irp Form T 141

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRP Form T 141 online

This guide provides step-by-step instructions for completing the IRP Form T 141 online. With clear guidance, users can navigate through the form efficiently, ensuring that all relevant information is accurately captured.

Follow the steps to effectively fill out the IRP Form T 141.

- Press ‘Get Form’ button to obtain the form and open it in your editor.

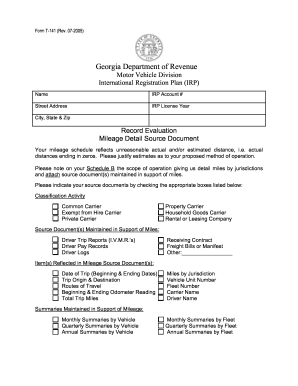

- Enter the name of the applicant in the designated field labeled 'Name'. This should be the person or entity applying for the IRP registration.

- Input the IRP account number in the appropriate section. This number is unique to your account and necessary for your application.

- Fill in the street address where the applicant is located. Ensure accuracy for correspondence purposes.

- Specify the IRP license year for which you are applying. This is crucial for assessing registration periods.

- Complete the city, state, and ZIP code fields accurately, as this will affect your records and communications.

- In the section for 'Record Evaluation', provide details regarding your mileage schedule, ensuring to justify any estimates. Indicate how your proposed method of operation affects the mileage reported.

- Check the appropriate boxes related to your classification activity. Options include common carrier, exempt from hire carrier, private carrier, property carrier, household goods carrier, and rental or leasing company.

- In the 'Source Document(s) Maintained in Support of Miles' section, select from the list provided, which documents support your reported mileage. Options include driver trip reports, driver pay records, driver logs, receiving contracts, freight bills, or any other supportive documents.

- Provide information on the items reflected in the mileage source documents, including date of trip, trip origin and destination, routes taken, beginning and ending odometer readings, and total trip miles.

- Complete the 'Miles by Jurisdiction' section by filling in vehicle unit number, fleet number, carrier name, and driver name as applicable.

- For summaries maintained in support of mileage, indicate the frequency of your summaries—monthly, quarterly, or annually—by vehicle and fleet.

- After filling all necessary fields, review the information for accuracy before saving your changes, then download, print, or share the form as needed.

Begin filling out your IRP Form T 141 online today for an efficient filing experience.

For the Missouri Form 1041, you should mail it to the address specified in the instructions provided with the form. This address may differ depending on whether you are making a payment or not. Always double-check the latest information from the Missouri Department of Revenue to confirm the correct mailing address. If you need assistance with state forms, UsLegalForms can provide helpful resources and guidance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.