Loading

Get Canada T3010b E 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T3010B E online

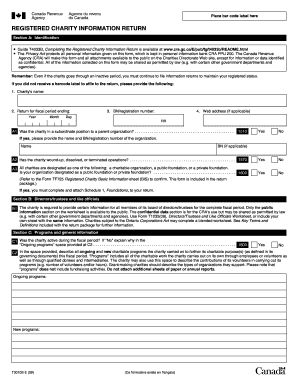

Completing the Canada T3010B E form is essential for registered charities in Canada to maintain their status. This guide will provide a clear and supportive approach to filling out the form online, ensuring you have all necessary information at hand.

Follow the steps to complete the Canada T3010B E form online.

- Press the ‘Get Form’ button to access the Canada T3010B E form and open it in the editor.

- In Section A, provide your charity's identification information. Include the charity's name, BN/registration number, and fiscal period ending date.

- For question A1, indicate if the charity was subordinate to a parent organization by selecting 'Yes' or 'No.'

- Answer A2 to confirm if the charity has wound up, dissolved, or ceased operations, selecting the appropriate option.

- In A3, identify your charity's designation as a charitable organization, public foundation, or private foundation.

- Proceed to Section B and provide the required information about the board of directors or trustees, using Form T1235 or your own sheet if necessary.

- In Section C, confirm if the charity was active in the fiscal period by answering C1, and describe ongoing and new charitable programs in C2.

- Answer C3 to indicate if the charity made gifts to qualified donees, and complete Form T1236 if applicable.

- Complete Section D, focusing on financial information such as total assets and liabilities. If your charity meets specific criteria, proceed to Schedule 6.

- Finally, in Section E, ensure a director or trustee certifies the form by signing and providing the necessary information, then save your changes.

- You can now save your completed form, download it, print it, or share it as needed.

Begin your document management journey by completing the Canada T3010B E form online today.

When returning to Canada, you need to complete the Canada customs declaration form. This is the same form used when entering Canada, which helps to declare goods you are bringing back. Ensuring that you use the correct form, such as the Canada T3010B E for specific purposes, will help avoid complications at the border.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.