Loading

Get Dc Fr-800sf 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC FR-800SF online

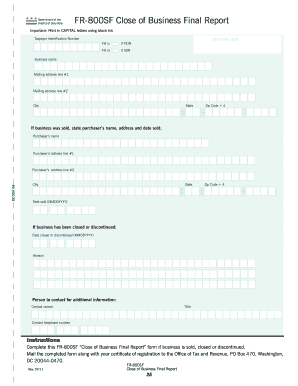

Filling out the DC FR-800SF, also known as the Close of Business Final Report, can be essential for businesses that have been sold, closed, or discontinued. This guide provides clear and supportive instructions to help users accurately complete this form online.

Follow the steps to fill out the DC FR-800SF efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your Taxpayer Identification Number. If you are using a Federal Employer Identification Number (FEIN), mark the appropriate box and fill in the number. If using a Social Security Number (SSN), fill in that section instead.

- In the Business Name section, fill in the official name of your business as it appears on your registration documents.

- Complete your Mailing Address. Use Mailing Address Line #1 and Mailing Address Line #2 if necessary to provide a full address. Include the City, State, and Zip Code (+4).

- If your business has been sold, provide the purchaser’s information by filling in the Purchaser’s Name, Mailing Address, City, and the Date Sold in the MMDDYYYY format.

- If your business has been closed or discontinued, enter the Date Closed or Discontinued in the MMDDYYYY format and state the reason for closure.

- Designate a Contact Person for additional inquiries by providing their Name, Title, and Contact Telephone Number.

- Once all fields are completed, review the information for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Take the first step towards completing your DC FR-800SF online today!

The DC food tax is a local tax imposed on the sale of food and beverages sold in Washington, D.C. This tax is applied to non-prepared food items and some beverages at retail establishments. Understanding how this tax integrates with your overall business strategy can be helpful when completing forms like the DC FR-800SF.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.