Loading

Get Tsp-77 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-77 online

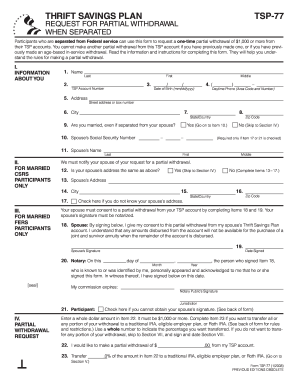

The TSP-77 form is essential for participants who have separated from Federal service to request a one-time partial withdrawal from their Thrift Savings Plan account. This guide offers clear, step-by-step instructions on how to complete the form effectively online.

Follow the steps to complete the TSP-77 accurately.

- Click the ‘Get Form’ button to obtain the TSP-77 form and open it in your preferred editor.

- Begin by filling out Section I with your personal information, which includes your name, TSP account number, and address. Ensure that the date of birth is entered in the proper format (mm/dd/yyyy).

- Indicate your marital status in Item 9 and provide your spouse’s details if applicable, as it is required for notifications related to the partial withdrawal.

- In Section III, if you are a married FERS participant, ensure that your spouse signs and dates Items 18 and 19, and that their signature is notarized in Item 20.

- Proceed to Section IV where you will specify the amount you wish to withdraw in Item 22. The minimum withdrawal amount is $1,000.

- Complete Item 23 if you wish to transfer any part of your withdrawal to a traditional IRA, eligible employer plan, or Roth IRA. Specify the percentage you want to transfer.

- If you opted for a direct deposit of the remaining amount, fill out Section VII with your financial institution details, including the routing number.

- Review all provided information for accuracy and completeness, and then sign and date Section VIII to certify the correctness of your details.

- Finally, save changes to your filled form, download it for your records, and submit it through mail or fax as per the instructions provided.

Start filling out your TSP-77 form online today and ensure your partial withdrawal is processed smoothly.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, TSP withdrawals are generally considered income, and they may be subject to federal, state, and local taxes. When you withdraw funds, keep in mind that these amounts can impact your taxable income for the year. Therefore, understanding how the TSP-77 affects your overall tax strategy is crucial.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.