Loading

Get Taxpayer Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxpayer Questionnaire online

Navigating the Taxpayer Questionnaire can feel overwhelming, but with the right guidance, the process can be straightforward. This guide provides clear, step-by-step instructions on how to fill out the Taxpayer Questionnaire online, ensuring you have all the necessary information ready.

Follow the steps to successfully complete the Taxpayer Questionnaire.

- Click the ‘Get Form’ button to obtain the Taxpayer Questionnaire and open it in the editing platform.

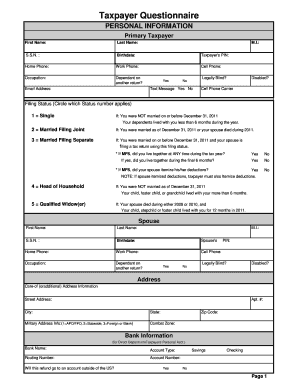

- Begin by filling out the personal information section. Provide your first name, last name, middle initial, social security number, birthdate, and taxpayer's PIN. Ensure your email address and phone numbers are accurate for future correspondence.

- Indicate your filing status by circling the number that corresponds to your situation—options include single, married filing jointly, married filing separately, head of household, or qualified widow(er). Review the criteria for each status carefully.

- Enter the spouse's personal information if you selected a married filing status. This includes their first name, last name, middle initial, social security number, and date of birth.

- In the address section, include your complete residential address along with any additional address information required.

- Complete the bank information section, including bank name, account type, routing number, and account number for direct deposit, ensuring to note if this refund will be sent outside the U.S.

- Fill out the dependents section. List each dependent's first and last name, birthdate, social security number, their relationship to you, and how many months they lived with you during the tax year.

- Proceed to complete the earnings section by reporting your wages, interest, and any other income, referring to corresponding tax forms as necessary.

- Review all itemized expenses, deductions, and credits. Ensure that any applicable credits related to child care and education are calculated.

- Finally, after reviewing your completed questionnaire for accuracy, save changes, download a copy, print it for your records, or share as needed.

Complete your Taxpayer Questionnaire online today for a smooth filing experience.

When completing your 1040 form, it is generally advisable to put a zero instead of leaving it blank if a field does not apply to you. This shows that you considered the entry and confirms that it doesn't apply. Utilizing a Taxpayer Questionnaire can guide you on best practices for completing your form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.