Loading

Get Sc Uce-151 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC UCE-151 online

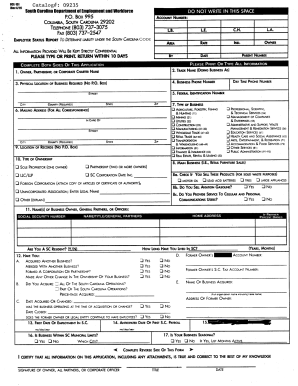

This guide provides comprehensive instructions on how to complete the SC UCE-151 form online. It is designed to assist users through the form-filling process, ensuring clarity and accuracy in reporting employment information.

Follow the steps to complete the SC UCE-151 form successfully.

- Click ‘Get Form’ button to obtain the SC UCE-151 document and open it in your preferred online editor.

- Begin by entering the total wages paid to South Carolina workers by calendar quarter, as specified in item 18. Fill out the fields for each quarter, listing the year and corresponding wages for the periods from January through March, April through June, July through September, and October through December.

- In item 19, indicate the number of employees for each calendar week of the year. Provide numbers for every month from January to December, accounting for part-time, commission workers, sales personnel, officers, and others.

- In item 20, indicate whether you filed a FUTA Form 940 with the IRS for the last completed calendar year by selecting 'Yes' or 'No'.

- Item 21 inquires if your organization is exempt from federal income taxes under section 501-C-3 of the IRS code. If it is, select 'Yes' and ensure to attach a copy of the exemption letter.

- For item 22, confirm whether your business consists solely of agricultural employment by selecting 'Yes' or 'No'.

- In item 23, specify if your employment consists solely of domestic workers. Choose 'Yes' or 'No'.

- Address item 24, which asks if the unit reported is made up of multiple establishments in the state. If applicable, respond with 'Yes' and provide further details in the space provided, including the exact location and employment county for each establishment covered by the report.

- Complete the certification statement at the end of the form by signing and dating it, providing the name of the employing unit and your official position.

- After completing the form, ensure that you save changes, download a copy, print it out, or share it as necessary.

Complete your SC UCE-151 form online today for accurate reporting!

Filling out a withholding allowance form requires careful attention to detail. You’ll begin by providing your personal information, followed by stating the number of allowances you wish to claim accordingly. This form affects the amount of tax withholding on your paycheck, so ensure that the information is as accurate as possible. For clarity and further help, you can turn to resources from USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.