Loading

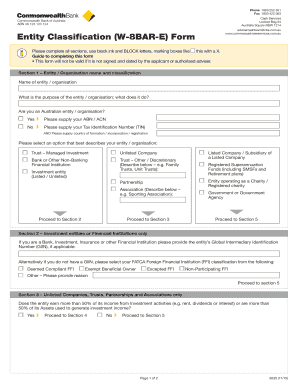

Get Entity Classification Form - Commsec Adviser Services

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Entity Classification Form - CommSec Adviser Services online

Filling out the Entity Classification Form - CommSec Adviser Services online is an essential process for entities looking to comply with regulatory requirements. This guide will provide you with a clear, step-by-step approach to successfully complete the form, ensuring you meet all necessary criteria.

Follow the steps to accurately complete the form.

- Click ‘Get Form’ button to obtain the Entity Classification Form and open it for completion.

- In Section 1, enter the entity or organisation name. Describe its purpose and indicate if it is an Australian entity by selecting 'Yes' or 'No'. Provide your ABN/ACN, Tax Identification Number (TIN), and the country of formation, incorporation, or registration.

- Select the option that best describes your entity or organisation from the provided list, including trusts, companies, and associations.

- Skip to Section 2 if your entity is classified as a Bank, Investment, Insurance, or other Financial Institution. Provide your Global Intermediary Identification Number (GIIN) if applicable, or select the appropriate FATCA Foreign Financial Institution (FFI) classification.

- For unlisted companies, trusts, partnerships, and associations, proceed to Section 3. Indicate whether the entity earns more than 50% of its income from investment activities. Depending on your answer, proceed to either Section 4 or Section 5.

- In Section 4, provide information on beneficial owners and controlling persons. Include full name, date of birth, position, residential address, percentage of ownership, and country for each individual listed.

- Complete any additional requirements for individuals who are residents, citizens, or tax residents of countries other than Australia; list all relevant countries.

- In Section 5, confirm your declaration by checking all statements regarding the accuracy of the information provided. Ensure it is signed and dated by the applicant or authorised adviser.

- Once all sections are completed, you can save your changes, download the form, print it for your records, or share it as needed.

Begin completing your Entity Classification Form online today and ensure your entity's compliance.

A W-8BEN document is a tax form that needs to be filled by non-US residents. It is issued by the Internal Revenue Service (IRS) to individuals whose nationality and country of residence are not the United States.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.