Loading

Get The Debt Snowball Worksheet Answers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out The Debt Snowball Worksheet Answers online

Filling out The Debt Snowball Worksheet can help users create a structured plan to effectively manage and pay off debt. This guide will provide clear, step-by-step instructions on how to complete the worksheet online and maximize its effectiveness.

Follow the steps to effectively complete The Debt Snowball Worksheet.

- Press the ‘Get Form’ button to access the worksheet and open it in the online editor.

- Begin by entering your name and the date in the designated fields at the top of the worksheet to personalize it.

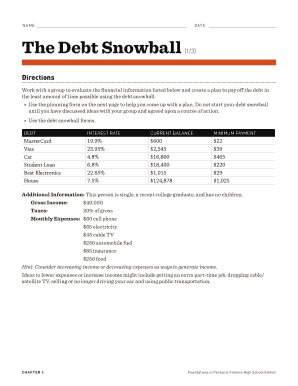

- Next, identify all debts you are planning to pay off and list them in the 'DEBT' section. Include the type of debt for each entry, such as credit card or loan.

- For each debt, enter the corresponding interest rate, current balance, and minimum payment in the respective columns. This data is critical for developing your repayment strategy.

- In the 'Current Monthly Income' section, input your total income and calculate your monthly expenses. Make sure to be thorough to understand your financial situation better.

- Use the 'Ideas to Lower Expenses or Increase Income' section to brainstorm ways to improve your financial standing. This may include reducing unnecessary expenses or seeking additional work.

- Once you have evaluated your financial situation and strategized, fill out the Proposed Monthly Income and Monthly Expenses fields to reflect any changes.

- Finally, prepare your Plan of Action by summarizing the steps you intend to take to pay off your debts. Make sure this plan is realistic and achievable.

- After completing all sections, review your entries for accuracy. You can then save your changes, download, print, or share the filled-out form as needed.

Start managing your debt effectively by completing The Debt Snowball Worksheet online now.

Related links form

Step 1: List your debts from smallest to largest regardless of interest rate. Step 2: Make minimum payments on all your debts except the smallest. Step 3: Pay as much as possible on your smallest debt. Step 4: Repeat until each debt is paid in full.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.