Loading

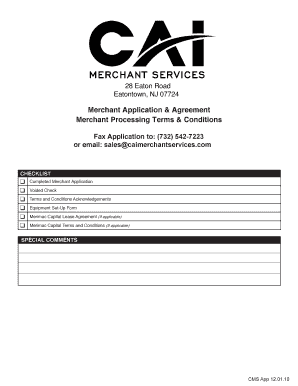

Get Merchant-services-application-120110-enabled-w-w9pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Merchant-services-application-120110-enabled-w-W9pdf online

This guide provides clear, step-by-step instructions for filling out the Merchant-services-application-120110-enabled-w-W9pdf online. By following these steps, you can easily complete the application and ensure all necessary information is provided accurately.

Follow the steps to complete your application effectively.

- Click the ‘Get Form’ button to access the Merchant-services-application-120110-enabled-w-W9pdf online.

- Begin by providing your business's exact legal name as shown on your Federal Tax Return. This should be clearly printed in the designated field.

- Complete the contact information section by entering the corporate and DBA phone numbers and email addresses. These should be current and accurate for correspondence purposes.

- In the merchant profile section, select your type of ownership from the provided options and include your federal tax number. Be sure to describe the type of goods or services sold.

- Indicate whether you have previously accepted Visa or MasterCard services, including details about your most recent processor if applicable.

- Provide a detailed business bank account information, including account numbers and routing details. An attached voided check is typically required for verification.

- Complete the owners or officers section with all relevant personal details, then ensure that the required signatures are provided in the acknowledgments section.

- Review the Merchant Processing Terms and Conditions, acknowledging completion and comprehension by signing where indicated.

- Finally, save your changes, and use the options available to download, print, or share your completed form.

Complete your Merchant-services-application-120110-enabled-w-W9pdf online now for a smooth processing experience.

The W-9 helps the payee avoid backup withholding; where the payee certifies on the W-9 that they are not subject to backup withholding. This allows them to receive the full payment due to them from the payer. It's similar to the withholding exemption certification in the W-4 Form for employees.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.