Loading

Get R10606 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the R10606 Form online

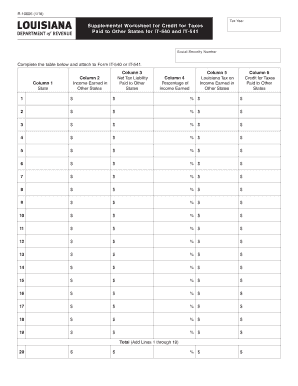

The R10606 Form, known as the Supplemental Worksheet for Credit for Taxes Paid to Other States for IT-540 and IT-541, is essential for individuals who have earned income in other states and wish to claim a tax credit. This guide will walk you through the steps to fill out this form online, ensuring you provide accurate information.

Follow the steps to complete the R10606 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the designated online editor.

- Enter the tax year in the specified field at the top of the form.

- Provide your social security number in the dedicated field. Ensure this is accurate for proper identification.

- In Column 1, list each state where you earned income. Use as many lines as necessary to include all relevant states.

- In Column 2, enter the income earned in each corresponding state as reported on your tax returns.

- In Column 3, input the net tax liability you indicated on your return for each state. This is a crucial figure and does not come from W-2 forms.

- Calculate the percentage of income earned in that state compared to your Louisiana adjusted gross income and fill in Column 4. Round your answer to two decimal places.

- Multiply the percentage from Column 4 by your Louisiana income tax to find the amount for Column 5. Ensure this is rounded to the nearest dollar.

- In Column 6, enter the lesser amount between Column 3 and Column 5. This represents your credit for taxes paid to other states.

- After completing all columns, calculate the total for Column 6 and enter it on Line 20. Ensure all figures are accurate by reviewing your entries.

- Once you have filled out the form completely, save changes, download, print, or share the form as necessary.

Start filling out the R10606 Form online today to ensure you claim the credits you're entitled to.

For failure to file a return on time, a penalty of 5 percent of the tax accrues if the delay in filing is not more than 30 days. An additional 5 percent penalty accrues for each additional 30 days or fraction thereof during which the failure to file continues, not to exceed a total of 25 percent.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.