Loading

Get Mn Ucb Form 30.1.1 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

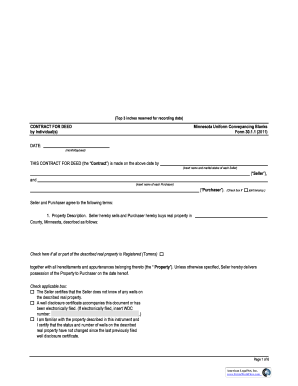

How to fill out the MN UCB Form 30.1.1 online

Filling out the Minnesota Uniform Conveyancing Blanks Form 30.1.1 online can streamline your real estate transactions and ensure accuracy. This guide provides a step-by-step approach to help you fill out the form with ease and confidence.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor for filling.

- Enter the date of the contract at the top of the form, specifying the month, day, and year.

- In the section for Sellers, list the names and marital statuses of each Seller involved in the transaction.

- In the Purchasers section, input the names of each Purchaser participating in the agreement.

- If applicable, check the box indicating if the property will be held in joint tenancy by the Seller and Purchaser.

- Provide a description of the property, including the county and specific details as necessary.

- Indicate if the property is Registered (Torrens) by checking the corresponding box.

- Fill in any applicable details regarding wells located on the property by checking the appropriate box and providing the well disclosure certificate number if it has been electronically filed.

- In the Title section, detail any exceptions to the title warranty that applies on the date of the contract.

- Specify the purchase price in dollars and outline the payment structure as indicated in the Purchase Price section.

- Detail the terms of prepayment rights, if applicable, according to the agreement.

- Clarify who will be responsible for real estate taxes and special assessments in the Real Estate Taxes section.

- Include any insurance obligations for the property as outlined in the Property Insurance section.

- Complete any additional sections related to property damage, liability, and compliance with laws as necessary.

- When finished, review the entire form for accuracy. Once confirmed, proceed to save changes, download, print, or share the completed form as needed.

Start completing the MN UCB Form 30.1.1 online today to facilitate your property transaction.

Related links form

In Minnesota, the maximum allowable interest rate for a contract for deed is set at 10 percent annually. This limit aims to protect buyers from excessive financing charges. Understanding this rate is crucial when considering the terms of a contract for deed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.