Loading

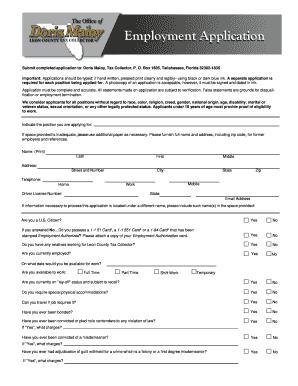

Get Submit Completed Application To Doris Maloy, Tax Collector, P

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Submit Completed Application To Doris Maloy, Tax Collector, P online

This guide provides a comprehensive overview of how to accurately complete the Submit Completed Application to Doris Maloy, Tax Collector, P. By following these steps, you will ensure your application is filled out correctly and submitted efficiently.

Follow the steps to successfully complete your application online.

- Press the ‘Get Form’ button to obtain the application and open it in your preferred editor.

- Fill in your personal information including your full name (last, first, and middle), address (street, city, state, and zip), and contact numbers (home, mobile, work). Ensure that you provide accurate details.

- Indicate the position you are applying for in the specified section. If you need more space, attach additional paper as necessary.

- Complete the citizenship section by indicating if you are a U.S. citizen and, if applicable, provide details about your Employment Authorization card.

- Answer questions regarding employment status, availability for work, and if you require any special accommodations.

- Provide a detailed account of your educational background, including schools attended, major or minor fields of study, and any degrees awarded.

- List your work history, starting from your most recent position. Include job titles, company names, city/state, duties performed, and contact information for supervisors.

- Include the names and contact information of three references who are not related to you and whom you have known for at least one year.

- If applicable, complete the veterans' preference section, ensuring you include any necessary documentation.

- Carefully read the drug-free workplace policy and the certificate of applicant section, then certify the accuracy of your information by signing and dating the application.

- Review your entire application to ensure all fields are completed and information is accurate before saving your changes.

- Once satisfied with your application, you can download, print, or share your completed form as needed.

Begin your application process and ensure all documents are submitted online today.

This option is also known as the Gonsalves-Deukmejian-Petris Property Tax Assistance Law. If you are a California resident 62 or over, are a low-income resident, and/or have qualifying disabilities, you may be able to apply for cash assistance from the state for property taxes. What is this?

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.