Loading

Get Nc Ncui 101-b

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC NCUI 101-B online

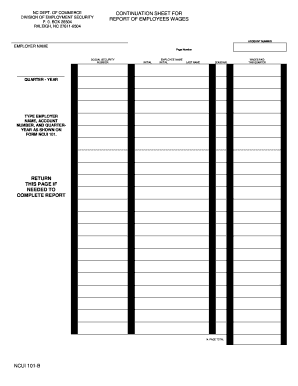

The NC NCUI 101-B is an essential form used to report employees' wages. This guide provides a detailed approach to help you complete the form accurately and efficiently online.

Follow the steps to correctly fill out the NC NCUI 101-B form.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Enter the account number in the designated field. This number is unique to your employment account and is necessary for proper identification.

- Fill in the employer name as it appears on the original NCUI 101 form. This ensures that your report is linked to the correct employer profile.

- Input the page number to indicate the sequence of this continuation sheet in your report, helping maintain organization.

- Provide the social security number of the employee accurately. Ensure that this information is confidential and correctly recorded.

- Complete the employee name by entering their first name, initials, and last name in the appropriate fields to maintain comprehensive records.

- Indicate if the employee is seasonal by selecting the appropriate checkbox if applicable.

- Specify the quarter and year for which the wages are being reported. This data is crucial for accurate record-keeping and compliance.

- Double-check that the employer name, account number, and quarter/year are consistent with the details shown on the original NCUI 101 form to avoid discrepancies.

- Enter the total wages paid this quarter in the designated section. This information should reflect the actual payments made to the employee.

- If additional space is needed to complete the report, return this page as required.

- Once all fields are filled out, you can save your changes, download, print, or share the form as needed.

Complete your documentation online with confidence and accuracy.

In North Carolina, the payroll tax rate varies but generally falls around 1% to 5.7% depending on the employer's experience rating. Employers are responsible for collecting and remitting this tax to fund unemployment insurance. Understanding these rates is crucial for budgeting and compliance. To stay informed, keep an eye on resources like NC NCUI 101-B for the latest updates.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.