Loading

Get Canada Gst25 E 2008-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST25 E online

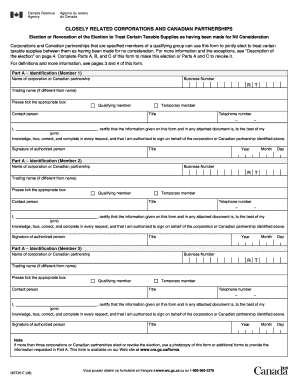

The Canada GST25 E form allows corporations and Canadian partnerships to jointly elect to treat certain taxable supplies as having been made for no consideration. This guide provides clear instructions for completing the form online, ensuring users can efficiently navigate each section's requirements.

Follow the steps to complete the Canada GST25 E form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part A, provide the identification details for Member 1 including the name of the corporation or Canadian partnership, business number, and trading name if applicable. Select the appropriate box for member status (qualifying member, contact person, or temporary member) and enter the telephone number and title of the authorized person.

- Certify the information by printing the name of the authorized person, signing the form, and entering their title along with the date (month, year, and day). Repeat this process for Members 2 and 3 in the designated sections, ensuring all information is accurate.

- Move to Part B where you will need to assess eligibility for the election by ticking the relevant boxes that apply to the qualifying members identified in Part A. Ensure that all criteria are met for the specified members.

- In Part C, choose whether to elect or revoke the election by ticking the appropriate box and entering the effective date. Note any exceptions applicable to the election.

- Once all parts are completed, review the form for accuracy. Users can save changes, download, print, or share the completed form.

Complete your Canada GST25 E form online today.

GST With Foreign Clients As a general rule, goods that are exported outside of Canada and services rendered to non-residents are zero-rated under the GST/HST rules. This means that they're technically taxable, but at a rate of 0%, you don't have to charge anything.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.