Loading

Get Professional Liability Insurance Occurrence Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Professional Liability Insurance Occurrence Application online

Completing the Professional Liability Insurance Occurrence Application online is a vital step for professionals seeking insurance coverage. This guide provides clear, step-by-step instructions tailored to assist users in accurately filling out the application.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to access the application form and open it in your chosen online editor.

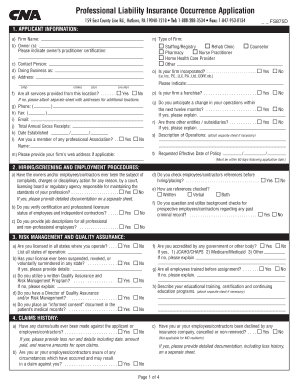

- In the applicant information section, provide the firm's name, owner(s), and their practitioner certifications. Specify the type of firm, such as Staffing/Registry or Rehab Clinic.

- Identify the contact person and indicate if the business is operating under a different name. Fill in the address details, including city, state, and zip code.

- Confirm whether the firm is a franchise and if there are any expected changes in operations over the next year, providing explanations where required.

- Respond to questions about the firm's incorporation status and if all services are provided from the listed location.

- Complete the hiring/screening and employment procedures section by marking 'Yes' or 'No' to various employment verification questions and detailing how references and background checks are conducted.

- Fill out the risk management and quality assurance section, indicating licensing status in the operational states and documenting any past license issues.

- In the claims history section, disclose any past claims made against the applicant or employees, noting if there are any known circumstances that could lead to future claims.

- Proceed to the professional liability section to detail employees/independent contractors, including their professions and annual payrolls.

- Specify the location where services are provided, ensuring the total percentage equals 100%. Likewise, complete the type of services provided section, again ensuring total percentage equals 100%.

- Indicate whether the firm provides overnight services and disclose previous professional liability insurance coverage for the past five years.

- Decide if you would like optional general liability coverage, completing the necessary sections if 'Yes' is selected.

- Confirm the existence of written agreements with third parties and note any mutual indemnification or hold harmless agreements.

- Fill in the agent/broker information, sign the application, and add the date.

- Once you have filled out all sections, review your inputs for accuracy and completeness. Save changes, download, print, or share the form as needed.

Start your Professional Liability Insurance Occurrence Application online today!

The per-occurrence limit is the most your insurance company will pay for a single covered loss under the terms of your policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.