Loading

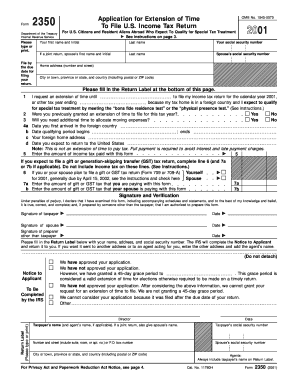

Get 2001 Form 2350. Application For Extension Of Time To File U.s. Individual Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2001 Form 2350. Application For Extension Of Time To File U.S. Individual Income Tax Return online

Filing for an extension to file your U.S. income tax return can be a straightforward process, especially with the 2001 Form 2350. This guide will provide you with clear, detailed instructions to help you successfully complete the form online.

Follow the steps to fill out your 2001 Form 2350 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editing interface.

- Enter your first name, middle initial, and last name in the designated fields. If you are filing jointly, include your spouse's first name, middle initial, and last name as well.

- Fill in your social security number and your spouse's social security number if applicable. This information is crucial for identification purposes.

- Provide your home address, including number and street, city or town, province or state, country, and postal or ZIP code. Ensure that all information is accurate and complete.

- Request your extension by indicating the date until which you wish to extend your filing. State the calendar year or tax year you are applying for.

- Indicate whether you were previously granted an extension for this tax year by selecting 'Yes' or 'No.'

- If applicable, specify whether you require additional time to allocate moving expenses and provide relevant dates regarding your arrival in the foreign country.

- Specify the date you expect to return to the U.S. and provide your foreign home address.

- Fill out the line indicating the amount of income tax paid with this form, and include details regarding any gift or generation-skipping transfer tax return if necessary.

- Sign and date the form in the designated areas for both the taxpayer and the spouse, if filing jointly. If someone else prepared the form, that person must sign as well.

- Lastly, complete the Return Label at the bottom of the page with your, your spouse's, and any agent's information if applicable.

- Once all sections are complete, review the form for accuracy. You can then save changes, download, print, or share the filled form as needed.

Prepare and file your documents online today for a smooth tax extension process.

You can obtain tax extension forms, including the 2001 Form 2350, from several reliable sources. The IRS website is the primary location where you can find all official forms. Alternatively, platforms like US Legal Forms simplify access by providing the forms along with assistance on how to fill them out. This ensures you have the correct forms at your fingertips, making your tax filing process smoother.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.