Loading

Get Pa-34-v1-0.pdf - Revenue Nh

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Pa-34-v1-0.pdf - Revenue Nh online

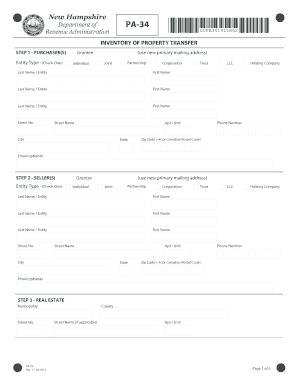

Filling out the Pa-34-v1-0.pdf form is essential for reporting property transfers to the New Hampshire Department of Revenue Administration. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the form correctly.

- Press the ‘Get Form’ button to download the form and open it in an appropriate viewer.

- Identify the purchaser(s) by selecting the applicable entity type and enter their details, including names, addresses, and contact information.

- For the seller(s), select the applicable entity type and provide their complete information in the same manner as the purchaser(s).

- In the 'Real Estate' section, fill in the municipality, county, street number and name, parcel identification number, acreage, and property use details.

- Complete the 'Deed' section by entering the transfer date, recording date, sale price, and type of transfer. Include required book and page numbers.

- Answer the questions in the 'Transaction Detail' section, providing information on fair market value, percentage of interest transferred, and details about any furnishings or improvements.

- If filled out by someone other than the purchaser, complete the 'Preparer' section with the preparer's details.

- Sign the form in the 'Signatures' section. Ensure that the purchaser's signature(s) and preparer's signature (if applicable) are included.

- Review the entire form for accuracy, then save any changes made. You can download, print, or share the completed form as needed.

Complete and submit the Pa-34 form online to ensure compliance with New Hampshire property transfer regulations.

The amount due each year is based on the Tax Rate Calculation which is set in the fall each year by the Department of Revenue Administration. The tax rate for 2021 is $20.55 per thousand at 78.1% valuation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.