Loading

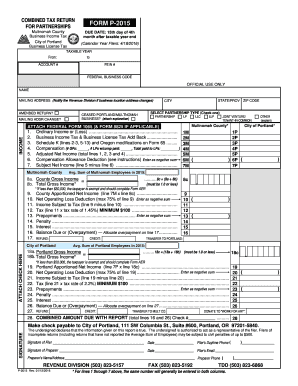

Get Combined Tax Return Form P-2015 For Partnerships

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the COMBINED TAX RETURN FORM P-2015 FOR PARTNERSHIPS online

The COMBINED TAX RETURN FORM P-2015 is an essential document for partnerships operating within Multnomah County and the City of Portland. Filling this form out accurately is crucial for ensuring compliance with local tax regulations.

Follow the steps to complete the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Enter the taxable year for which you are filing. Ensure that you fill in both the start and end dates.

- Fill in the business name and mailing address. If there are any changes in the business location, notify the Revenue Division accordingly.

- Indicate if this is an amended return by selecting 'Yes' or 'No'.

- Select the partnership type by checking the appropriate box (e.g., Partnership, LP, LLC, LLP, Joint Venture).

- If applicable, indicate if your business has ceased, and attach any explanation as required.

- Attach a copy of the Federal Form 1065 and, if applicable, Form 8825 to your submission.

- Complete the income sections by providing ordinary income or loss figures as instructed.

- Calculate and enter the business income tax and business license tax add back as per the guidelines.

- Determine the adjusted net income by summing the line items previously mentioned.

- Follow the same process for the Multnomah County and City of Portland sections for gross income, apportioned net income, and any applicable deductions.

- After filling in all sections, review the totals for any balance due or overpayment calculations.

- Lastly, sign the form, date it, and provide contact details for both the filer and preparer if applicable.

- Save changes, download or print the completed form for your records, and prepare to submit it.

Ensure you complete your document filing online today to meet the due dates and maintain compliance.

Who needs to file a 1065? All partnerships in the United States must submit one IRS Form 1065 unless there was no income or expenditures for the year. The IRS defines a “partnership” as any relationship existing between two or more persons who join to carry on a trade or business.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.