Loading

Get Scottrade Alternate Payee Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Scottrade Alternate Payee Form online

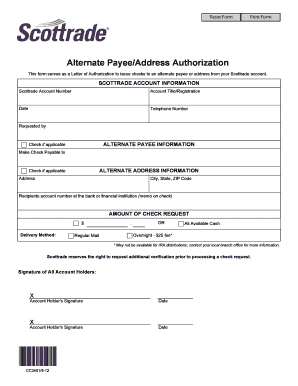

The Scottrade Alternate Payee Form allows you to authorize checks to be issued to an alternate payee or address from your Scottrade account. This guide will provide you with detailed, step-by-step instructions to help you complete the form online.

Follow the steps to fill out the Scottrade Alternate Payee Form

- Click the ‘Get Form’ button to obtain the Scottrade Alternate Payee Form and open it in a suitable editor.

- In the Scottrade account information section, enter your Scottrade account number, the title or registration of the account, the date, and your telephone number. Provide the name of the person making the request.

- In the alternate payee information section, indicate if applicable by checking the box. Then, specify the name to whom the check should be payable.

- Fill out the alternate address information section, checking the box if applicable. Enter the alternate address including city, state, and ZIP code.

- In the next section, indicate the recipient's account number at the bank or financial institution, if applicable, which should be noted in the memo on the check.

- Specify the amount of the check request by entering the desired dollar amount.

- Select the delivery method for the check from the options provided: regular mail, overnight (with a $25 fee), or all available cash. Note that overnight delivery may not be available for IRA distributions.

- All account holders must sign in the designated areas, ensuring each signature is dated.

- Once all sections are completed, save your changes, and choose to download, print, or share the completed form as needed.

Complete your Scottrade Alternate Payee Form online today to ensure smooth processing of your check requests.

Related links form

Yes, a QDRO distribution is generally considered taxable income to the alternate payee when received. Although the alternate payee may avoid early withdrawal penalties, it is essential to report this income for tax purposes. It is advisable to consult a tax professional when handling funds from a Scottrade Alternate Payee Form to ensure compliance with tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.