Loading

Get Student Loan Debt Burden Mandatory Forbearance Request. Use This Form To Request A Student Loan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Student Loan Debt Burden Mandatory Forbearance Request. Use This Form To Request A Student Loan online

This guide will help you navigate the process of completing the Student Loan Debt Burden Mandatory Forbearance Request form online. By following these steps, you can ensure that your request for forbearance is submitted accurately and effectively.

Follow the steps to fill out the forbearance request form correctly.

- Press the ‘Get Form’ button to obtain the necessary form, which will open in your editor for completion.

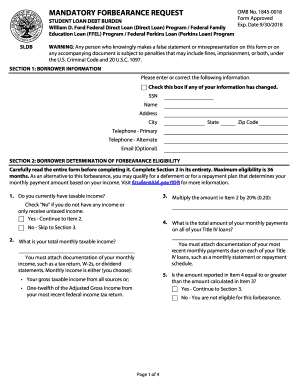

- Complete Section 1: Borrower Information. Enter your Social Security Number (SSN), name, address, city, state, and zip code. Include your primary and alternate telephone numbers, and an optional email address. If any information has changed, check the corresponding box.

- Move to Section 2: Borrower Determination of Forbearance Eligibility. Read the instructions carefully. Answer whether you have taxable income by checking 'Yes' or 'No'. If 'Yes', proceed to provide your total monthly taxable income and other necessary documentation.

- If you have taxable income, you will be required to calculate a percentage of your income. After completing those calculations, provide the total monthly payments you currently owe on all Title IV loans. Ensure to attach documentation supporting both your income and current payments.

- If you are determined eligible, continue to Section 3: Borrower Requests, Understandings, Certifications, and Authorization. Here, request the forbearance period and specify whether you wish to temporarily stop payments or make smaller payments.

- You must also note the start date for the forbearance period and indicate how long you want the forbearance to last, up to a maximum of 12 months.

- This section also requires you to certify that the information is correct and to authorize communication regarding your request. Sign and date the form.

- Refer to Section 4 for instructions on completing the form. Use dark ink and provide applicable documentation. If loans are held by different holders, submit a separate request for each.

- Finally, return the completed form and required documentation to the address listed in Section 6 or to your loan holder, as indicated. If needed, you can contact your loan holder for assistance.

Act now to complete your forbearance request online and manage your student loan obligations effectively.

Both allow you to temporarily postpone or reduce your federal student loan payments. The main difference is if you are in deferment, no interest will accrue to your loan balance. If you are in forbearance, interest WILL accrue on your loan balance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.