Loading

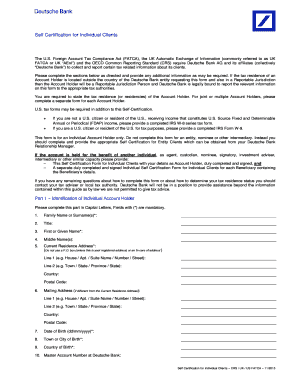

Get Self Certification For Individual Clients - Deutsche Bank

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Certification For Individual Clients - Deutsche Bank online

Filling out the Self Certification For Individual Clients form for Deutsche Bank is an essential step for compliance with tax regulations. This guide will provide clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Self Certification form seamlessly.

- Click ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin with Part 1, which requires your identification details. Fill in your family name or surname, title, first name, middle name, current residence address, mailing address (if applicable), date of birth, town or city of birth, country of birth, and your master account number at Deutsche Bank. Ensure fields marked with (*) are filled, as they are mandatory.

- Move to Part 2 and certify your U.S./Non-U.S. status. Indicate whether you are a U.S. person by checking the appropriate box and provide your Tax Identification Number (TIN) if applicable.

- In Part 3, declare your country of residence for tax purposes and provide the related TIN or functional equivalent. Fill in the corresponding fields, and if you do not have a TIN, specify the reason as instructed.

- Proceed to Part 4, where you will provide a declaration and signature. Ensure you understand the terms and conditions, then sign and print your name, along with the date of signing. If signing on behalf of the Account Holder, indicate your capacity and attach any supporting documents, such as a power of attorney if applicable.

- Once all sections are completed, review the form for accuracy. Save any changes and download a copy for your records. You may also choose to print or share the completed form if required.

Complete your Self Certification form online today to ensure compliance with tax regulations.

Please follow the steps given below for online Self-Certification: Log-in to your NPS account (please visit .cra-nsdl.com) Click on sub menu “FATCA Self-Certification” under the main menu “Transaction” Submit the required details under “FATCA/CRS Declaration Form”

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.