Loading

Get 145g Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 145g Form online

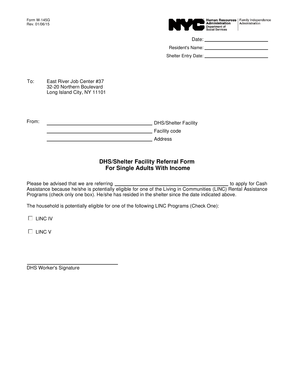

Filling out the 145g Form online is a straightforward process designed to assist individuals seeking cash assistance through the Living in Communities programs. This guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the 145g Form online:

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Enter the date on which you are completing the form at the top of the document.

- Provide the resident's name in the designated field below the date.

- Fill in the shelter entry date, which is the date the individual began residing in the shelter.

- Specify the East River Job Center location by writing 'East River Job Center #37' and its address, '32-20 Northern Boulevard, Long Island City, NY 11101', in the appropriate section.

- Complete the section indicating the DHS/Shelter Facility by entering the facility name and code, as well as its address.

- Indicate which LINC program the household is potentially eligible for by selecting one option from the list provided.

- Have the DHS worker sign the form in the designated signature area.

- Review all entered information for accuracy and completeness.

- Save your changes, then download, print, or share the 145g Form as required.

Complete your 145g Form online today to expedite your application process.

Yes, you need to submit a copy of Form 15G at each bank branch where you receive interest payments. If the interest obtained from all branches exceeds Rs. 10,000, TDS will be deducted.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.