Get Co Dor Form Dr 1666

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Co Dor Form Dr 1666 online

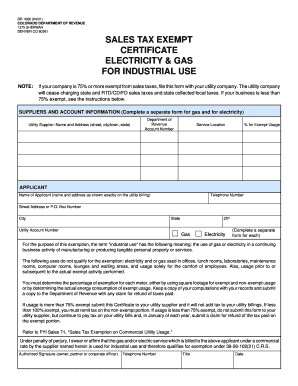

This guide provides a clear and detailed approach for filling out the Co Dor Form Dr 1666 online, a vital document for claiming sales tax exemption for industrial use of electricity and gas. Whether you're familiar with digital forms or new to the process, this guide aims to assist you in completing the form accurately.

Follow the steps to successfully fill out the Co Dor Form Dr 1666 online.

- Click the ‘Get Form’ button to obtain the Co Dor Form Dr 1666 and open it in your chosen online editor.

- Fill out the 'Suppliers and Account Information' section. Provide the name and address of your utility supplier for both gas and electricity. Make sure to include your Department of Revenue account number and the service location.

- Indicate the percentage of usage that qualifies for exemption in the '% for Exempt Usage' field. This percentage should be based on either square footage or actual energy consumption used for industrial purposes.

- Complete the 'Applicant' section. Enter your name and address as shown on the utility billing, along with your telephone number, street address or P.O. Box number, city, state, and ZIP code.

- Provide your utility account number for both gas and electricity. Remember, if your business operates on a separate form for each utility, ensure that each form is filled out accurately.

- Under the certification section, affirm the statement regarding the usage of the gas and/or electric service. Include your authorized signature (owner, partner, or corporate officer), along with their title and telephone number. Finally, date the form.

- Once you have completed all sections of the form, save your changes. You can then choose to download, print, or share the completed Co Dor Form Dr 1666 as needed.

Complete your Co Dor Form Dr 1666 online today to ensure your business benefits from the sales tax exemption!

To fill out a schedule K form, begin by acquiring the Co Dor Form Dr 1666 for guidance. This form will help you report the relevant income, deductions, and credits applicable to your situation. Ensure that you gather all necessary financial records to provide accurate information. Double-check all entries for accuracy prior to submission.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.