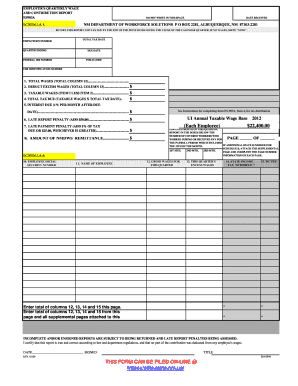

Get Nm Es903 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NM ES903 online

How to fill out and sign NM ES903 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Obtaining a certified professional, arranging a planned meeting, and visiting the office for a face-to-face discussion renders completing a NM ES903 from start to finish exhausting.

US Legal Forms allows you to swiftly generate legally binding documents according to ready-made online templates.

Quickly generate a NM ES903 without engaging professionals. Over 3 million individuals are already utilizing our extensive collection of legal forms. Join us today and gain access to the top collection of online templates. Experience it for yourself!

- Obtain the NM ES903 you require.

- Access it using the cloud-based editor and commence modifications.

- Complete the blank sections; names of involved parties, residences, and contact numbers, etc.

- Replace the blanks with specific fillable fields.

- Add the exact date and affix your electronic signature.

- Click Done after thoroughly reviewing all the information.

- Store the completed documents on your device or print it out as a physical copy.

How to modify Get NM ES903 2009: customize templates online

Handling documentation is easier with intelligent web applications. Get rid of physical paperwork using conveniently downloadable Get NM ES903 2009 formats you can adjust online and print.

Creating files and records should be simpler, whether it's a routine aspect of one’s job or sporadic tasks. When one needs to submit a Get NM ES903 2009, understanding guidelines and instructions on how to fill out a form properly and what it should consist of can take considerable time and effort. Nevertheless, if you locate the correct Get NM ES903 2009 format, completing a document will cease to be a challenge with a savvy editor available.

Uncover a broader assortment of features you can incorporate into your document management workflow. There's no need to print, complete, and annotate forms manually. With an intelligent editing platform, all essential document processing functionalities will always be accessible. If you aim to enhance your workflow with Get NM ES903 2009 forms, search for the template in the library, select it, and find an easier approach to fill it out.

The more tools you are acquainted with, the simpler it becomes to operate with Get NM ES903 2009. Explore the solution that provides all necessary functionalities to find and edit forms within a single browser tab and forget about manual documentation.

- If you wish to incorporate text in any section of the form or add a text field, utilize the Text and Text field tools to expand the text in the form as extensively as necessary.

- Leverage the Highlight tool to emphasize the crucial sections of the form. If you want to conceal or eliminate certain text fragments, employ the Blackout or Erase tools.

- Tailor the form by inserting default graphic elements. Utilize the Circle, Check, and Cross tools to add these elements to the forms as required.

- If you need more annotations, use the Sticky note function and place as many notes on the forms page as necessary.

- Should the form necessitate your initials or the date, the editor provides tools for that purpose. Reduce the likelihood of mistakes utilizing the Initials and Date features.

- It's also feasible to include custom visual elements within the form. Use the Arrow, Line, and Draw tools to modify the document.

Related links form

NM unemployment benefits are calculated based on your highest earning quarters during your base period. The state will review your work history and earnings to determine the amount you are eligible to receive. It’s important to report accurate income to ensure you receive the correct benefit amount. Understanding how this calculation works helps in planning your finances while you seek new employment.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.