Loading

Get Employer Cafeteria Plan Salary Redirectionreduction Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employer Cafeteria Plan Salary Redirection/Reduction Agreement online

This guide provides clear and supportive instructions on filling out the Employer Cafeteria Plan Salary Redirection/Reduction Agreement online. Whether you are new to this process or looking for a refresher, this step-by-step approach will help you complete the form with confidence.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the document and open it in your selected digital format.

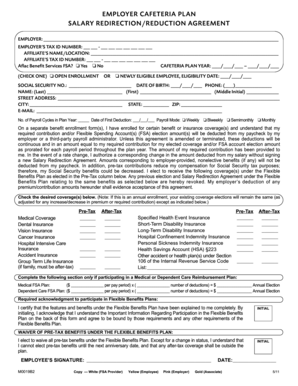

- Begin by filling in the employer's name and tax ID number in the designated fields at the top of the form.

- Next, provide the affiliate's name and location along with their corresponding tax ID number.

- Indicate whether you are an Aflac Benefit Services FSA participant by checking 'Yes' or 'No'.

- Specify the cafeteria plan year by entering the start and end dates in the appropriate fields.

- Select whether you are enrolling during open enrollment or if you are a newly eligible employee, and indicate your eligibility date if applicable.

- Enter your social security number, date of birth, and contact phone number.

- Fill in your name, street address, city, state, and ZIP code.

- Provide your email address for communication purposes.

- Enter the number of payroll cycles in the plan year and the date of the first deduction.

- Select your payroll mode (weekly, biweekly, semimonthly, or monthly).

- Confirm your enrollment in any benefit or insurance coverage and understand that deductions will occur continuously throughout the plan year.

- Select your desired coverage options from the provided lists and indicate whether these contributions will be pre-tax or after-tax.

- Complete the medical and dependent care FSA plan sections by inputting amounts per pay period and the total annual election.

- Initial to acknowledge understanding the features of the Flexible Benefits Plan, and sign and date the agreement.

- Review the completed form for accuracy before saving, downloading, printing, or sharing as necessary.

Complete the Employer Cafeteria Plan Salary Redirection/Reduction Agreement online today for seamless participation in your benefits.

What is a cafeteria plan? Cafeteria Plans are an employer-sponsored benefit that lets employees pay certain qualified medical expenses – such as health insurance premiums for medical, dental, and vision coverage – on a pre-tax basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.