Loading

Get From Form 1041 2010 It-205 Fiduciary Income Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the From Form 1041 2010 IT-205 Fiduciary Income Tax Return online

Completing the From Form 1041 2010 IT-205 Fiduciary Income Tax Return online can streamline the process of reporting income for estates and trusts. This guide provides clear and detailed instructions to ensure users can complete the form accurately and efficiently.

Follow the steps to fill out your fiduciary income tax return online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

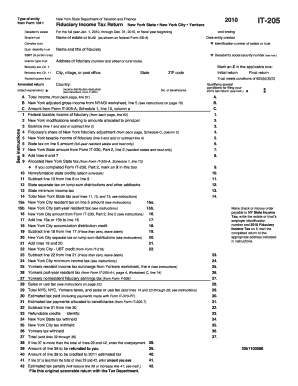

- Provide the name of the estate or trust as shown on the federal Form SS-4 in the designated field. If applicable, indicate the type of entity by marking the appropriate box: decedent’s estate, simple trust, complex trust, or other specified types.

- Enter the identification number for the estate or trust and the date the entity was created. Additionally, fill in the name and title of the fiduciary along with their address, including city, state, and ZIP code.

- Mark the box indicating whether this is an initial return, final return, amended return, or related to bankruptcy. Specify if the trust meets the conditions of section 605(b)(3)(D) if applicable.

- Complete the income section, starting with the total income derived from the back page, line 51. Ensure all applicable income distribution deductions and beneficiary details are accurately reported.

- Calculate the New York adjusted gross income using the provided worksheet, and enter it in the specified field. Follow the instructions carefully for any federal taxable income adjustments.

- Proceed to calculate the New York taxable income of the fiduciary by completing the specified lines for tax amounts and adjustments, including state tax and any nonrefundable state credits.

- Review the New York City and Yonkers taxes. Enter amounts as required and ensure the correct subtotals and totals are calculated.

- Double-check all entries for accuracy, and then save changes to ensure a copy is created. You may download the completed form, print it, or share it as needed.

Complete your fiduciary income tax return online easily and efficiently.

The fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files Form 1041 to report: The income, deductions, gains, losses, etc. of the estate or trust. The income that is either accumulated or held for future distribution or distributed currently to the beneficiaries.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.