Loading

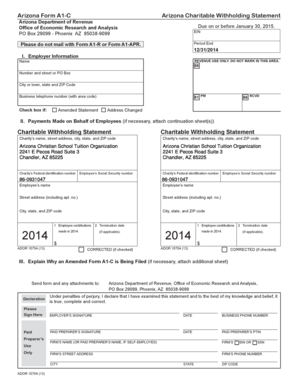

Get Instructions Arizona Form A1c Arizona Charitable Withholding Statement Arizona Department Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Instructions Arizona Form A1C Arizona Charitable Withholding Statement Arizona Department Of online

Filling out the Arizona Form A1C Charitable Withholding Statement can seem complex, but with clear instructions, it can be completed efficiently. This guide provides step-by-step assistance to ensure you fill out the form accurately and submit it correctly.

Follow the steps to fill out the form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- In the Employer Information section, enter the employer’s name, address, and business phone number. Make sure to fill in all fields accurately.

- If applicable, check the box if this is an amended statement or if the address has changed.

- Input the Employer Identification Number (EIN) to the right of the employer's name.

- For Section II, complete an individual Charitable Withholding Statement for each charity to which the employer has made payments on behalf of an employee. Use continuation sheets if necessary.

- In Box 1, record the total amount of employee contributions made to the chosen charity in 2014, ensuring that you do not round the amount.

- If applicable, enter the employee’s termination date in Box 2.

- Review all entries for accuracy, and then sign and date the declaration at the bottom of the form.

- Maintain copies of the submitted form for your records and provide a copy of the individual Charitable Withholding Statement to the employee.

- Finally, ensure that you save, download, print, or share the form as needed.

Complete your documents online today and ensure all required forms are submitted accurately and on time.

As of January 1, 2023, the new default withholding rate for the Arizona flat income tax is 2.0%. If employees don't submit an updated Form A-4, employers may withhold a baseline of 2.0% starting in 2023.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.