Get Tenn Code Ann Section 67 6 301c2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tenn Code Ann Section 67 6 301c2 Form online

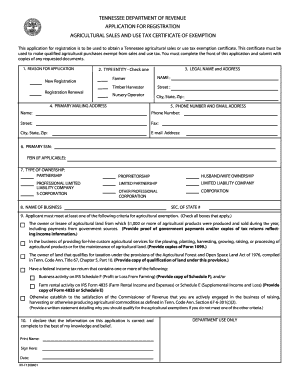

Completing the Tenn Code Ann Section 67 6 301c2 Form online is a straightforward process designed for those seeking an agricultural sales and use tax exemption certificate in Tennessee. This guide will provide you with step-by-step instructions to ensure your form is completed accurately and efficiently.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editing tool.

- Indicate your reason for application by selecting either 'New Registration' or 'Registration Renewal' in the appropriate section.

- Specify the type of entity you are by checking one of the options: Farmer, Timber Harvester, or Nursery Operator.

- Provide the legal name and address of the business or individual applicant. Ensure all fields are filled in accurately.

- Enter the primary mailing address, including street, city, state, and zip code, where correspondence should be sent.

- Fill in the phone number and email address for the contact person related to the application.

- Input the primary Social Security Number (SSN) or Federal Employer Identification Number (FEIN) if applicable.

- Select the type of ownership that applies to your business from the options provided.

- Enter the name of your business and the Secretary of State number if it is not a sole proprietor or partnership.

- Check all qualifications that apply to your application for agricultural exemption. Ensure to attach supporting documentation as required.

- Review all entries for accuracy. The applicant must then provide their printed name, signature, and the date on which the application is submitted.

- After confirming that all information is correct, you can save changes, download, print, or share the completed form as needed.

Complete your agricultural sales and use tax exemption application online today.

Tennessee Code Annotated 67 6 313 specifies the conditions under which certain sales are exempt from sales tax. This is particularly important for organizations such as non-profits, which often benefit from tax exemptions to further their missions. Understanding this section can help ensure you take advantage of any applicable exemptions. To learn more about the necessary documentation, including the Tenn Code Ann Section 67 6 301c2 Form, visit US Legal Forms for resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.