Loading

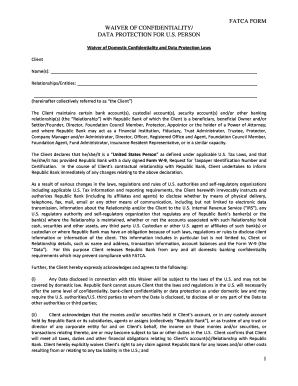

Get Fatca Form Waiver Of Confidentiality Data Protection For

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FATCA form waiver of confidentiality data protection for online

Filling out the FATCA form waiver of confidentiality data protection is a crucial step for U.S. persons conducting banking activities abroad. This guide will provide clear instructions on how to complete the form online, ensuring you understand each section and its significance.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by filling in your name(s) in the designated field. Ensure you provide the full legal name as it appears on official documents.

- In the 'Relationships/Entities' section, describe your connection to the bank accounts or entities involved. This could include your role such as beneficiary or director.

- Acknowledge that you are a 'United States Person' by selecting or annotating the appropriate area. It is essential to be clear about your status under U.S. tax laws.

- Indicate that you have submitted Form W-9 to Republic Bank by checking the corresponding box or providing a brief statement, as required.

- Review the statements regarding the waiver of confidentiality and ensure you understand the implications. It is vital to recognize that data shared may not enjoy the same level of protection under U.S. law.

- Sign the form where indicated, confirming that all information provided is accurate and that you consent to the terms laid out in the document. Ensure the date of signature is included.

- If applicable, have any co-account holders sign and date the form as well, ensuring all necessary parties are represented.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed for submission.

Complete your FATCA form waiver of confidentiality accurately by following these steps, and handle your banking needs with confidence.

Every Form 1099 sent out contains a “FATCA filing requirement” checkbox. This is true for virtually all variations of Form 1099, including: Form 1099-MISC.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.