Loading

Get Ma Form Pc 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA Form PC online

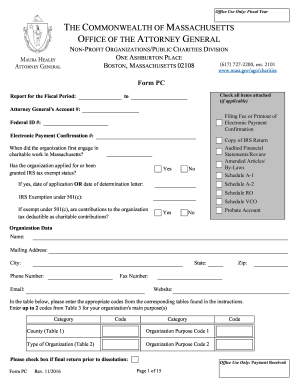

Filling out the MA Form PC is an essential step for organizations operating in Massachusetts that engage in charitable work. This guide provides clear, step-by-step instructions on how to accurately complete the form online.

Follow the steps to complete the MA Form PC online.

- Use the ‘Get Form’ button to access the MA Form PC online and open it in the editing platform.

- Begin by entering the Attorney General's Account number assigned to your organization. This is a required field for processing your form correctly.

- Fill in the organization's Federal ID number and the electronic payment confirmation number if applicable. Be sure to double-check these entries for accuracy.

- Indicate the date your organization first engaged in charitable work in Massachusetts and whether it has applied for or been granted IRS tax-exempt status. If applicable, enter the date of application or the determination letter.

- Provide the necessary documents such as the IRS Return and Audited Financial Statements if required. Ensure to check the appropriate boxes indicating the appended items.

- Complete the section about the organization's data, including Name, Mailing Address, City, State, Phone Number, Zip Code, Fax Number, Email, and Website. Accurate contact information is vital.

- In the table provided, select up to two codes from Table 3 that correspond to your organization’s main purpose(s) and provide the necessary information as instructed regarding the organization type and purpose.

- Answer all remaining questions concerning the organization’s creation date, financial data summary, compensation details for employees, and related party transactions. Be thorough and honest in your responses.

- Finalize the document by reviewing it for errors or omissions. Ensure all mandatory sections are complete and prepared for submission.

- Once you are satisfied with the form, save your changes. You can then choose to download, print, or share the completed MA Form PC as necessary for your records or submission.

Complete your documents online today for a seamless filing experience.

Filing the Massachusetts Form PC is a straightforward process. First, gather all relevant information about your non-profit, including its mission and activities. Then, fill out the MA Form PC accurately and submit it to the appropriate state office, either online or by mail. You can find user-friendly resources on platforms like USLegalForms to guide you through the filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.