Loading

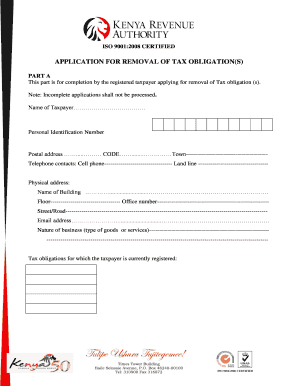

Get Ke Application For Removal Of Tax Obligation(s)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KE Application for Removal of Tax Obligation(s) online

Filling out the KE Application for Removal of Tax Obligation(s) online is a straightforward process that allows registered taxpayers to initiate the removal of their tax obligations. Follow the guide below to ensure your application is completed accurately and efficiently.

Follow the steps to successfully complete your application.

- Click the ‘Get Form’ button to obtain the form and access it for editing.

- Begin by completing Part A of the form. Provide your name as the registered taxpayer, followed by your personal identification number.

- Fill in your postal address, including the postal code and town. Also, include your telephone contacts, such as a cell phone number and a landline.

- Input your physical address. This should include the name of the building, floor, office number, and street or road.

- Enter your email address to ensure you can be contacted regarding your application.

- Indicate the nature of your business by describing the type of goods or services you provide.

- List the tax obligations for which you are currently registered.

- Specify the tax obligation(s) that you wish to have removed from your records.

- Provide clear reasons for your request to remove the tax obligation(s). Be as detailed as possible.

- Attach any necessary documentary evidence that supports your request for removal, if applicable.

- Ensure you include copies of your personal identification number, certificate of incorporation, business registration, and any relevant documentary evidence.

- Complete the section for the name of the applicant, position or designation, and provide your signature along with the date.

- Once all sections are completed, review your application for accuracy before saving.

- Finally, save the changes made, and if needed, download, print, or share the completed form.

Start your application process online today to ensure successful removal of your tax obligations.

Related links form

Avoiding IRS income tax penalties requires timely filing and payment of taxes owed. Staying organized with your tax records and understanding tax obligations can prevent issues. By utilizing the KE Application for Removal of Tax Obligation(s), you might also clarify your tax status and reduce future penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.