Loading

Get Uk Hmrc Vat484 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC VAT484 online

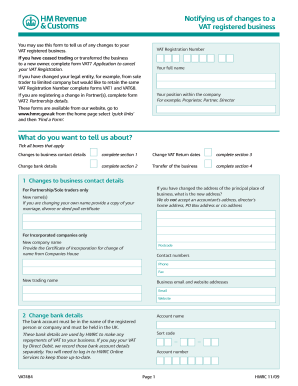

This guide provides a step-by-step approach to filling out the UK HMRC VAT484 form online. It is essential for notifying HMRC of any changes to your VAT registered business, ensuring your information remains current and compliant.

Follow the steps to successfully complete the VAT484 form.

- Press the ‘Get Form’ button to access the VAT484 form and open it for completion.

- Fill in your VAT registration number accurately at the beginning of the form.

- Provide your full name in the designated field. If applicable, indicate any changes in your legal entity by completing forms VAT1 and VAT68 if you have transitioned from a sole trader to a limited company.

- Indicate your position within the company, such as Proprietor, Partner, or Director, to clarify your role.

- If there are changes in partners, complete form VAT2 with the updated partnership details.

- In the section labeled 'What do you want to tell us about?', tick all the applicable boxes to indicate the changes you are reporting, such as business contact details, bank account details, VAT return dates, or business ownership transfer.

- For changes to business contact details, provide the new principal place of business address and ensure it does not include accountant or home addresses. Input new contact numbers, trading name, email, and website links, if applicable.

- For change of bank details, list the account name, sort code, and account number. Ensure the account is under the name of the registered person or company and located within the UK.

- If requesting to change VAT return dates, select the desired ending month for your VAT returns and ensure compliance with any conditions for monthly submissions.

- If transferring the business, fill in the details of the new owner and specify whether they wish to keep the existing VAT registration number, noting any additional requirements for form completion.

- Make sure all changes are authorized by the appropriate person as outlined in the regulations, providing their position.

- Complete the declaration section, signing and dating the form, and indicating your capacity.

- Once completed, return the form to the appropriate address provided on the document.

Begin filling out the VAT484 form online today to ensure your business information remains up to date with HMRC.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can submit your VAT return on your own. HMRC provides online services that guide you through the process step by step. However, if you are unsure about the requirements, consider utilizing the assistance of platforms like US Legal Forms. They offer resources that ensure you file correctly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.