Get Ie Revenue Form Tr2

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Revenue Form TR2 online

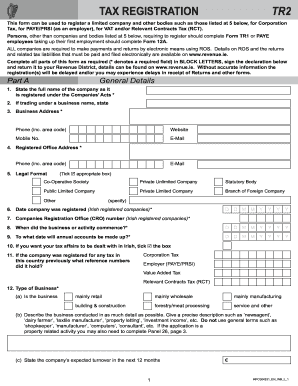

This guide provides a comprehensive overview of the specific steps necessary to accurately complete the IE Revenue Form TR2 online. By following the instructions outlined below, users can ensure a smooth registration process for various tax obligations.

Follow the steps to complete the IE Revenue Form TR2 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling out Part A, General Details. Provide your company's full name as registered under the Companies’ Acts, and if applicable, include any business name under which you are trading. Enter the business and registered office addresses, including contact details such as phone, email, and website.

- Indicate the legal format of your company by ticking the appropriate box. Include the date of registration and your Companies Registration Office (CRO) number. Also, provide the date your business commenced and the period for which annual accounts will be prepared.

- Complete details about your business type by answering specific questions regarding its nature, such as whether it is retail or manufacturing, and provide a precise description of the business activities.

- List the directors and company secretary details, ensuring accurate private addresses and PPSNs for each individual. Include information on shareholders with a 30% or more interest in the company.

- If applicable, fill in details regarding your accountant or tax adviser, and indicate whether they will handle correspondence related to your tax affairs.

- Proceed to Part B for Corporation Tax registration. If applicable, tick the box to indicate your registration for Corporation Tax.

- In Part C, fill out the VAT registration details. This includes the expected date from which the company requires VAT registration and selection of options based on your business activities.

- In Part D, complete the registration for PAYE/PRSI by providing the number of full-time and part-time employees, as well as the commencement date for payroll operations.

- For Part E, if applicable, register for Relevant Contracts Tax (RCT) by selecting the relevant option for Principal or Subcontractor status and provide the necessary dates.

- Finally, carefully review the details provided, complete the declaration by signing in BLOCK LETTERS, and ensure the capacity of the signatory is correctly noted. Once finalized, save your changes, and download, print, or share the form as necessary.

Complete the IE Revenue Form TR2 online today to meet your tax registration requirements.

Filling out a withholding exemption form requires accurate information about your tax status and circumstances. Start by gathering all relevant income documents and tax identification numbers. Ensure you follow the provided guidelines carefully to avoid common mistakes. Using services like US Legal Forms can assist you in filling out these forms correctly, ensuring you take advantage of available exemptions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.