Loading

Get Form 14 319

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 14 319 online

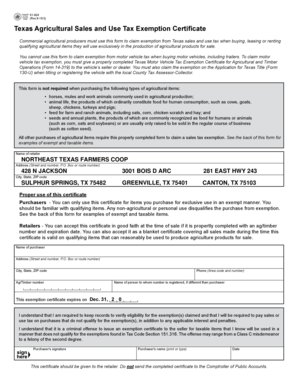

Filling out the Form 14 319 is an important step for agricultural producers seeking tax exemptions on eligible purchases. This guide will walk you through each section of the form and provide clear instructions to ensure a successful completion.

Follow the steps to fill out the Form 14 319 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the name of the retailer from whom you are purchasing qualifying agricultural items in the designated field.

- Fill in the retailer's address, including street, city, state, and ZIP code.

- In the 'Name of purchaser' section, provide your full name.

- Supply your complete address, including street, city, state, and ZIP code.

- Input your ag/timber number into the designated field to confirm your eligibility for the exemption.

- Include your phone number, including the area code, in the provided space.

- If applicable, add the name of the person to whom the ag/timber number is registered in the corresponding field; otherwise, leave it blank.

- Review the expiration date for the exemption, which typically states 'This exemption certificate expires on Dec. 31' followed by the current or upcoming year.

- Sign the form in the 'Purchaser's signature' section and print or type your name above it.

- Date the form in the appropriate field to indicate when the certificate is completed.

- Submit the completed form to the retailer. Do not send the certificate to the Comptroller of Public Accounts.

Complete your documentation online today to ensure you receive your tax exemptions promptly.

Beekeeping is the easiest and least expensive way to keep or obtain an AG valuation for an experienced beekeeper. Honeybees do not require fences, livestock trailers, veterinarians, hay, and you are not tied to the land.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.