Get Employee Earnings Record

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Employee Earnings Record online

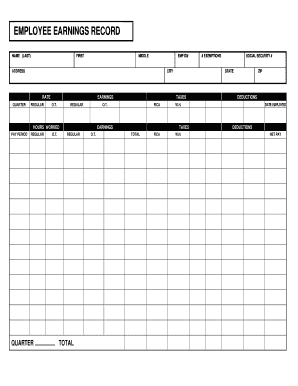

Filling out the Employee Earnings Record is essential for tracking your earnings and taxes throughout your employment. This guide provides detailed instructions on how to accurately complete the necessary fields to ensure your record is complete and precise.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to access the document and open it in your chosen digital editor or viewer for completion.

- Begin by entering your name. Fill in your last name in the designated field, ensuring accuracy for identification purposes.

- Next, provide your address. This section requires your street address, city, state, and ZIP code to ensure proper mailing of documents and correspondence.

- Indicate your employee ID number in the appropriate field. This number is used by your employer for payroll and record-keeping.

- Fill in your social security number. Be sure to enter this information carefully as it is used for taxation and identification.

- Record your employment start date in the ‘Date Employed’ field. This date should reflect when you began your current position.

- Fill in the quarter and pay period dates, which will assist in organizing and reporting your earnings accurately.

- Input your hours worked under both regular and overtime categories. Use the fields provided to specify the total hours for each.

- List your earnings in the corresponding fields for regular and overtime. Ensure these amounts reflect your actual income during the pay period.

- Enter tax exemptions, amounts for FICA deductions, and any other relevant deductions as necessary.

- Finally, review all the entered information for accuracy and completeness. Once satisfied, save your changes, and download or print the completed form for your records.

Get your Employee Earnings Record filled out accurately online today!

The best way to maintain employee records is by implementing an organized system that ensures accuracy and accessibility. Utilizing digital solutions for tracking details like the employee earnings record can help in automating updates and reducing manual errors. Platforms like UsLegalForms offer tools that simplify the management of these records, ensuring that all information is up-to-date and compliant with employment laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.