Get Fringe Benefit Statement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fringe Benefit Statement online

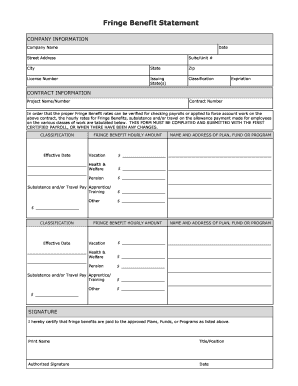

Completing the Fringe Benefit Statement is an essential step for ensuring compliance with labor regulations and accurately documenting employee benefits. This guide provides clear instructions for filling out the form online, making the process straightforward for users of all experience levels.

Follow the steps to fill out the Fringe Benefit Statement accurately

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the company information in the designated fields. This includes the company name, date, street address, suite/unit number, city, state, zip code, license number, issuing state(s), and classification. Ensure that all details are accurate.

- Provide the contract information by filling in the project name/number and contract number. This section is crucial for linking the benefits to the specific project.

- In the Fringe Benefit section, list the effective date for each classification. Fill out the hourly amount for vacation, health & welfare, and pension, along with the name and address of the plan, fund, or program. Repeat for each classification as necessary.

- Complete the subsistence and/or travel pay section, detailing amounts for apprentice/training and any other benefits applicable. Ensure that you appropriately fill out any additional required classifications.

- In the signature section, print your name, title/position, authorize your signature, and date the form. This certification confirms that fringe benefits are correctly paid to the approved plans, funds, or programs listed.

- After filling out all the required sections, ensure to review the form for any errors. Save changes, and choose to download, print, or share the form as necessary to submit it through the proper channels.

Complete your Fringe Benefit Statement online today to ensure compliance and accurate documentation.

When filing your tax return, fringe benefits are generally included in your gross income, as reported on your W-2. Ensure you accurately include this information to prevent discrepancies. If you have additional fringe benefits not reported on your W-2, you may need to report them separately. Consulting with a tax professional can help clarify this process for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.