Get Canada T4 Summary 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T4 summary online

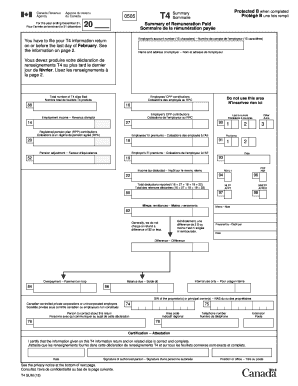

The Canada T4 summary is a crucial document for employers, summarizing the remuneration paid to employees and the deductions made for the tax year. This guide will provide you with step-by-step instructions to complete the T4 summary online, ensuring you meet the necessary requirements.

Follow the steps to complete the form accurately

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Fill in the employer's account number, ensuring it is exactly 15 characters long. This number identifies your payroll account with the Canada Revenue Agency.

- Provide the name and address of the employer. Make sure that this information matches what is on your statement of account.

- Report the total number of T4 slips filed. This includes all slips issued for the tax year.

- Complete the sections on employees' contributions, where you need to fill in the amounts for the Canada Pension Plan (CPP) and Employment Insurance (EI) as applicable.

- Enter the total deductions reported, which is the sum of all applicable deductions (lines 16, 27, 18, 19, and 22).

- If there are any remittances, note this in the appropriate section, as it shows the total amount that has been paid to the CRA.

- Complete the certification section, confirming that the information provided is accurate and complete. Include the date and the signature of an authorized person.

- Review all the information entered for accuracy before submission. Save changes, download the form, or print it as required.

Complete your Canada T4 summary online today to ensure timely filing and compliance.

Get form

Related links form

The T4 summary is a consolidated form that lists the total earnings and deductions for all employees under an employer’s payroll. It provides a clear overview that employers send to the Canada Revenue Agency. For individuals, receiving and understanding your T4 summary is crucial for filing taxes accurately and can benefit from platforms like USLegalForms to clarify any uncertainties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.