Loading

Get Solo 401k Transferrollover Form Pdf - Invesco

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Solo 401k Transfer/Rollover Form PDF - Invesco online

This guide provides step-by-step instructions for completing the Solo 401k Transfer/Rollover Form PDF provided by Invesco. Whether you are transferring or rolling over your eligible retirement assets, this comprehensive guide will walk you through each section of the form with clarity and support.

Follow the steps to complete your Solo 401k transfer or rollover form.

- Click ‘Get Form’ button to access the Solo 401k Transfer/Rollover Form PDF. This will allow you to open the document for completion.

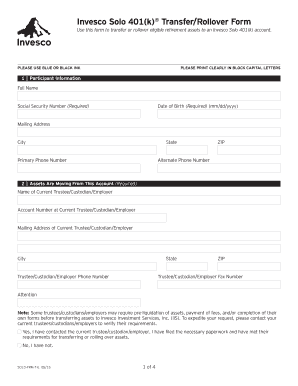

- In the participant information section, fill in your full name, Social Security number, date of birth, mailing address, city, state, primary phone number, and alternate phone number. Ensure that all details are written clearly in block capital letters.

- For the section regarding assets moving from your current account, include the name of the current trustee, custodian, or employer, the account number, their mailing address, city, state, phone number, and fax number. Mark whether you have contacted your current trustee/custodian/employer regarding any requirements they have for the transfer.

- In the instructions to the delivering trustee/custodian/employer section, select your account type that the funds are being transferred from. This includes options like Traditional IRA, 401(k), or others. Then, indicate the reason for the rollover and select your distribution instructions.

- In the assets moving to your Invesco Solo 401(k) account section, indicate whether this is a new account or an existing one by providing the Account ID. Specify the investment allocation by listing the fund names and the percentage allocation, ensuring that the total equals 100%.

- Complete the authorization and signatures section. Both the participant and the trustee must sign and date the form to authorize the rollover. Ensure that signatures are properly guaranteed if requested by your current trustee/custodian/employer.

- Finally, review the form for completeness and accuracy. Once confirmed, save your changes if working online, download, print, and sign the form as necessary. Mail the completed form along with any required documentation to the specified address.

Complete your Solo 401k transfer or rollover form online today to ensure a smooth transition of your retirement assets.

Related links form

Steps to Complete a Self-Employed 401k Rollover Contact your 401k plan's administrator to request the paperwork to roll your 401k over. Fill out and submit the paper work. Open the IRA at your chosen investment firm or bank. ... Deposit the proceeds from your 401k into your new IRA within sixty days.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.