Loading

Get Nv Nucs-4072 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NV NUCS-4072 online

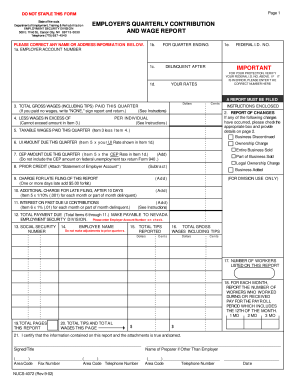

Filling out the NV NUCS-4072 form online is an essential task for employers in Nevada to report quarterly contributions and wages. This guide provides clear, step-by-step instructions to help you complete this form accurately and efficiently.

Follow the steps to fill out the NV NUCS-4072 form online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In section 1a, enter your employer account number. Ensure this number is accurate to avoid delays.

- For 1b, note the quarter ending date for which you are reporting.

- In section 1c, specify the date after which the report is considered delinquent.

- Complete section 1d by entering your federal identification number. If this number is incorrect, input the correct one in the designated field.

- In item 3, enter the total gross wages paid during the quarter, including tips. If no wages were paid, write 'NONE,' sign the report, and return it.

- For item 4, list any wages in excess of the amount reported in item 3 that are not taxable.

- Item 5 requires calculating the taxable wages by subtracting item 4 from item 3.

- For item 6, calculate the unemployment insurance (UI) amount due by multiplying item 5 by your UI rate shown in item 1d.

- In item 7, determine the CEP amount due for the quarter by multiplying item 5 by the CEP rate from item 1d.

- Go to item 8 and attach any prior credit statements as needed.

- In item 9, add a charge for late filing for reports submitted after the due date.

- For item 10, calculate additional charges for late filing after 10 days based on item 5.

- Item 11 needs you to compute interest due on past-due UI contributions as mentioned.

- Calculate the total payment due in item 12 by summing items 6 through 11.

- Provide social security numbers for all employees in item 13 to ensure proper crediting.

- List the full names of employees in item 14, including middle initials.

- In item 15, report the total tips as required for Internal Revenue purposes.

- Total gross wages including tips must be provided in item 16, ensuring it correlates with item 3.

- Enter the number of workers in item 17.

- For item 18, break down the number of workers for each month.

- Count the total pages for this report in item 19.

- Calculate and enter the total tips and total wages on this page in item 20.

- Sign and date the report at the bottom, certifying the accuracy of the information.

- After reviewing the completed form, save your changes, then download, print, or share your submission as required.

Complete your NV NUCS-4072 form online today to ensure compliance and avoid penalties.

Related links form

Filing Form 8974 with ADP involves providing the necessary details about your tax credits for the employer share of Social Security tax. You can complete the form by accessing the ADP platform and filling in the required fields related to your business. Always ensure that the information aligns with your records to manage your NV NUCS-4072 filings effectively and accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.