Loading

Get Ssa-7050-f4 2019

This website is not affiliated with any governmental entity

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SSA-7050-F4 online

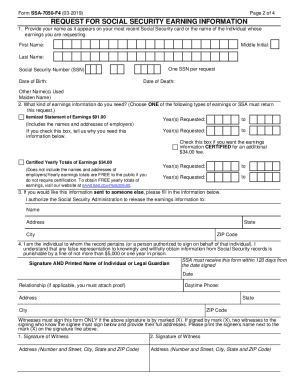

The SSA-7050-F4 form is a request for social security earning information, allowing users to obtain detailed earnings records. This guide will assist you in filling out the form accurately and efficiently online.

Follow the steps to complete the SSA-7050-F4 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your name as it appears on your most recent social security card or the name of the individual whose earnings you are requesting. Fill in the fields for first name, middle initial, and last name.

- Provide the social security number (SSN) of the individual linked to the earnings information you are requesting, along with their date of birth and date of death, if applicable.

- Select the type of earnings information you need by choosing either the itemized statement of earnings or certified yearly totals of earnings. Make sure to check the appropriate box.

- If requesting an itemized statement, indicate the years of earnings required by filling in the requested year ranges.

- If you want the information sent to someone other than yourself, complete section 3 with their name and address.

- Sign the form, either as the individual or as a person authorized to sign on behalf of that individual. Include the date and relationship, if applicable.

- If you signed with a mark (X), ensure there are two witness signatures along with their addresses.

- Review the form for accuracy. Ensure all fields are properly filled out and that the correct fee is calculated for the type of earnings information requested.

- Mail the completed form, along with any supporting documentation and payment, to the Social Security Administration within 120 days of the signature.

Start filling out your SSA-7050-F4 form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can get your personal Social Security Statement online by using your my Social Security account. If you don't yet have an account, you can easily create one. Your online Statement gives you secure and convenient access to your earnings records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.