Loading

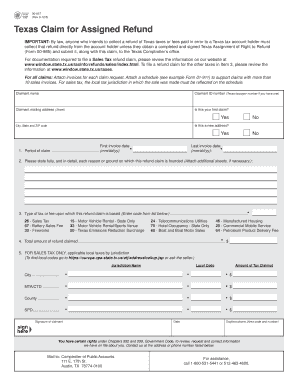

Get 00-957 Claim For Assigned Refund 00-957 Claim For Assigned Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 00-957 Claim For Assigned Refund online

Filing the 00-957 Claim For Assigned Refund online can seem challenging, but with a straightforward approach, you can complete it efficiently. This guide will walk you through each section of the form, ensuring you understand what information is needed.

Follow the steps to complete your claim form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing program.

- In the claimant name field, enter your full name as it appears on your tax records.

- If you have a Texas taxpayer number, enter it in the claimant ID number field. If not, you can leave it blank.

- Fill in your mailing address, including street address, city, state, and ZIP code. Make sure to provide accurate information.

- Indicate whether this is your first claim by selecting 'Yes' or 'No'.

- If your address has changed, select 'Yes' to notify the authorities. Otherwise, choose 'No'.

- Provide the first and last invoice dates by entering the respective dates in the format mm/dd/yy.

- In the explanation section, clearly state the reason for your refund claim. Attach additional sheets if necessary for more details.

- Identify the type of tax or fee that your claim is based on by entering the appropriate code from the provided list.

- Enter the total amount of the refund you are claiming in the designated field.

- For sales tax claims, fill out the applicable local taxes by jurisdiction, including jurisdiction name, local code, and amount of tax claimed.

- Sign and date the form in the designated signature field. Provide a contact number where you can be reached during the day.

- Once you have completed all sections, save your changes. You may also download, print, or share the form as needed.

Get started on your refund claim and fill out the 00-957 Claim For Assigned Refund online today!

Who is eligible for the sales tax refund? Full-year Colorado residents who were 18 or older as of Jan. 1, 2022, can get this refund by filing by April 18. If you file an extension, there are more limitations on whether you can claim it.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.